The room falls silent as Sarah, a first-time fund manager from Nairobi, practices her pitch to a mock Norwegian DFI representative. She’s confident talking about her investment thesis and market opportunity, but when the “LP” asks about her fund’s unique value proposition beyond returns, she stumbles.

This scene played out repeatedly in our 2X GP Sprint accelerator program, during our in-person session in Amsterdam last year.

Emerging fund managers who can articulate complex investment strategies struggled to answer one fundamental question: “Why should I invest in your fund versus the hundreds of other options on my desk?”

(Read also part I: What’s your LP Value Proposition?)

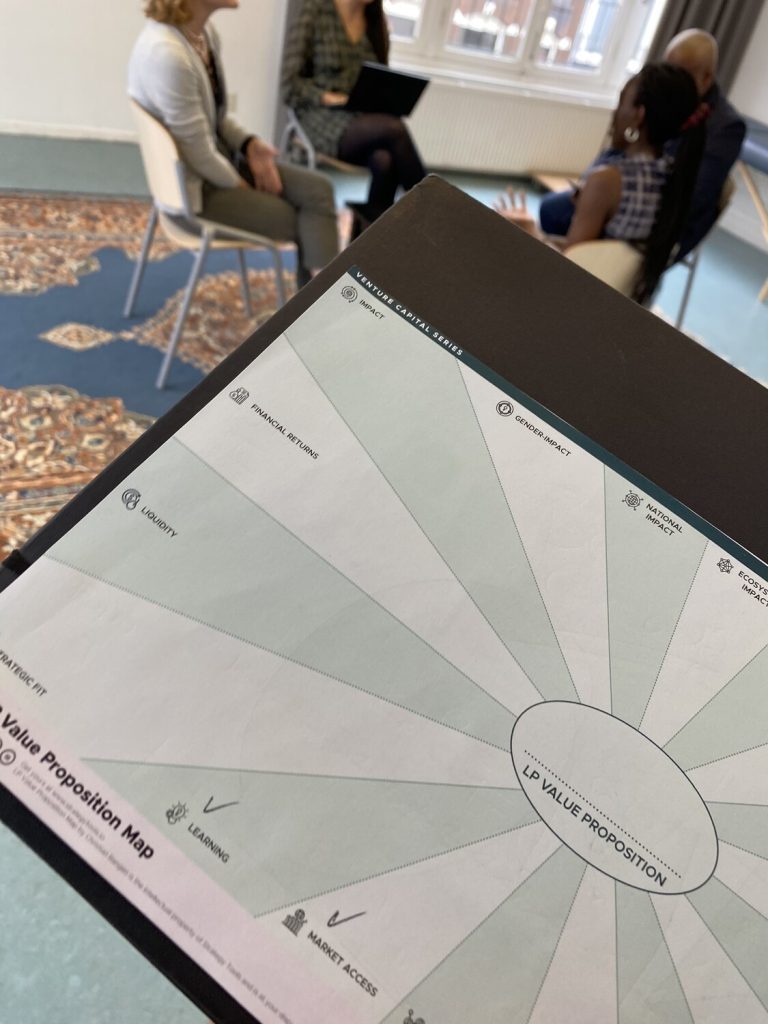

LP Value Proposition training in action, Amsterdam, 2024 (2X Ignite GP Sprint)

The LP Stack: Understanding Your Audience

The breakthrough came when we developed the LP Stack: Pitch Training Deck – a comprehensive training deck that brings LP personas to life through realistic role-playing scenarios. Rather than generic pitch practice, we immerse GPs in the actual mindset and priorities of different LP types.

Picture this: You’re pitching to what appears to be a straightforward family office, but the training card reveals they’re “Egyptian family office, mostly invested in real estate and tourism, no previous experience with venture capital, risk-averse, need to see clear return profile, not very active listener.” Suddenly, your standard VC pitch needs complete recalibration.

Meet the Egyptian family office. What would they care about if they were investing in your fund?

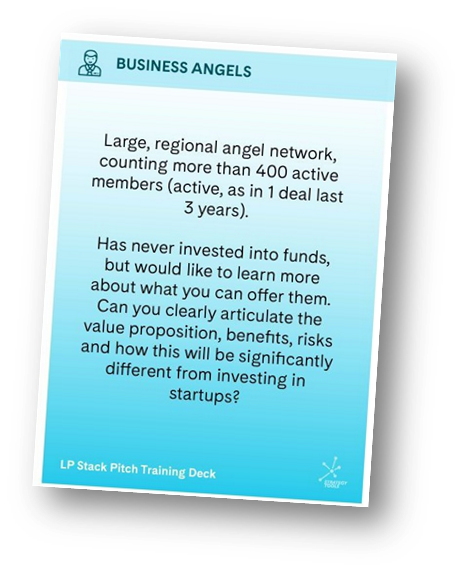

Or, “Large, regional angel network, counting more than 400 active members (active, as in 1 deal last 3 years). Has never invested into funds, but would like to learn more about what you can offer them. Can you clearly articulate the value proposition, benefits, risks and how this will be significantly different from investing in startups?” Clearly, a different conversation than the Egyptians, right?

What would entice an angel network to become an LP in your fund? What’s your unique and compelling value proposition for them?

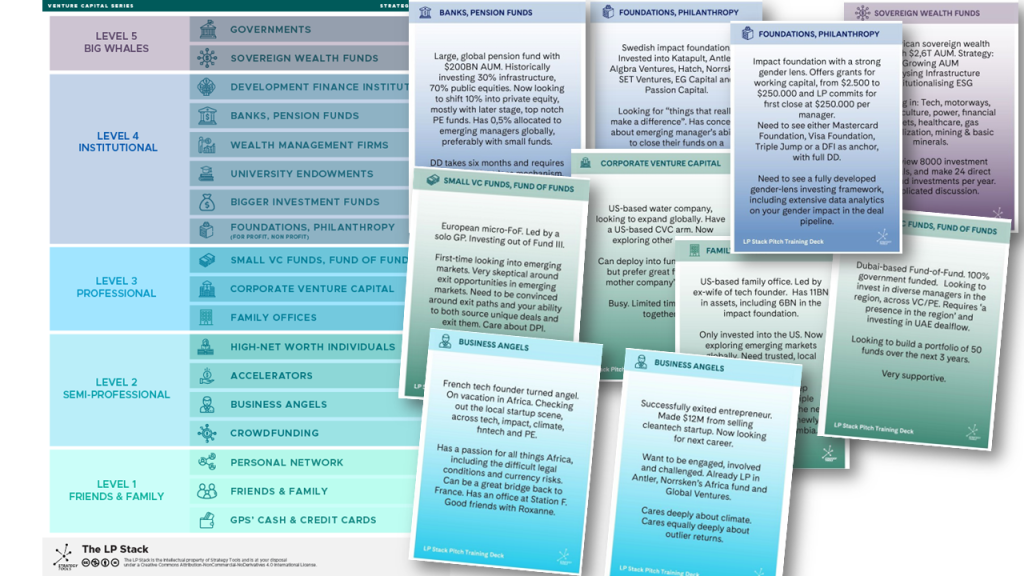

The LP Stack Contains Over 100 Detailed Personas Across Every Major LP Category:

Development Finance Institutions like the German DFI with “extensive experience investing into emerging markets, strong preference for Fund II/III due to learnings in Fund I, 24-month DD process, IC rejects 50% of deals, very structured and detail-oriented.”

Family Offices ranging from the supportive Norwegian impact-focused office to the flashy Italian fashion family with “rumors of mafia connections, love the lifestyle of being an LP, need to be present and seen, likes to talk about themselves.”

Sovereign Wealth Funds including the East African fund with “$2.6T AUM, reviews 8,000 investment proposals annually, makes 24 direct and 4 fund investments per year.”

Each persona isn’t just demographic data – it’s psychological profiling that reveals decision-making patterns, risk tolerance, ego drivers, and hidden motivations that determine investment decisions.

The training content is built around the LP Stack, organizing LPs in five levels, 18 categories. All cards are designed around real-life LPs, across these 18 categories. You might even recognize some of them here?

The Training Process: From Theory To Practice

Our training methodology follows a rigorous three-stage process:

Stage 1: LP Value Proposition Mapping

Using the LP Value Proposition Map, participants plot their fund’s strengths across 16 critical dimensions. This isn’t a feel-good exercise – it’s brutal self-assessment. Where are you genuinely differentiated versus merely competitive? The map forces GPs to move beyond generic claims about “superior returns” to articulate specific, measurable value propositions.

Stage 2: Persona Deep Dives

Participants draw LP Stack cards randomly and must immediately adapt their pitch to that specific persona. The intensity is intentional – you can’t rely on memorized presentations when facing a “slightly arrogant French corporate venture team expanding into new regions” versus a “shy, distant Danish family office that only invests alongside trusted co-LPs.”

Stage 3: Live Role-Playing

The real learning happens in simulated pitch sessions. Experienced practitioners play LP roles with method-acting intensity. The “impatient US wealth management firm in a hurry” actually interrupts presentations. The “very British DFI that won’t invest alongside shady family offices” asks probing questions about other LPs in the room.

A stack of LP profiles, the starting point to nail your LP Value proposition is to deeply understand the LP your are speaking with

What We’ve Learned: The Three Universal Truths

After training hundreds of emerging fund managers, three patterns emerge consistently:

Truth #1: LPs Care About More Than Returns

Every GP knows they need strong returns, but most underestimate how much LPs value operational excellence, impact measurement, governance standards, and relationship quality. The LP Value Proposition Map reveals that financial returns are just one of 16 evaluation criteria.

Truth #2: Different LPs Have Completely Different Priorities

A pension fund seeking 12% annual returns approaches decisions differently than an impact foundation focused on gender lens investing. Yet most GPs use identical pitches regardless of audience. The training forces customization based on deep LP psychology understanding.

Truth #3: Deeply understand LPs

The most successful training moments happen when GPs abandon their focus on the perfect pitch, and shift their attention to LPs, to truly, deeply trying to understand LPs. They ask questions. They are curious. “Seek to understand, not just to be understood”, as Stephen Covey would have said. GP’s understand, to be impactful, they need to engage with great, powerful questions, not just rapid-fire pitch decks.

The Workshop Dynamics: Where Learning Happens

The Amsterdam training rooms buzzed with nervous energy as participants cycled through different LP personas. A confident GP who dominated the corporate venture pitch may struggle completely when facing the “secretive Austrian family office that lost 100% of Africa investments and needs DFI anchor plus other family offices in the deal.”

The breakthrough were visible. Faces changed when a GP realizes their gender lens fund doesn’t just offer returns – it provides a “bragging rights” story for the Austrian family office, helps the Swedish DFI meet diversity mandates, and gives the university endowment a compelling narrative for stakeholders beyond just financial returns.

Beyond the Training Room: Real-World Application

The training’s effectiveness shows in results. GPs we have trained on nailing the LP Value Proposition tell us they have:

- Shortened fundraising cycles because they can immediately identify which LPs align with their value proposition

- Higher close rates when they pitch, as presentations are more precisely tailored to LP priorities

- Better LP relationships built on genuine understanding rather than generic partnerships

- More confident pitching because they’ve practiced against realistic, challenging scenarios

The Future Of Shaping Better LP-GP Relationships

As LP markets become increasingly sophisticated and competitive, the days of generic fund pitches are ending. LPs want partners who understand their motivations, constraints, objectives, and decision-making processes at a granular level.

The LP Value Proposition training methodology prepares emerging fund managers for this reality. By deeply understanding LP psychology through realistic role-playing, GPs develop the empathy and adaptability needed for successful fundraising.

The next time you’re in a pitch meeting, remember: your LP isn’t evaluating just your fund – they’re evaluating whether you understand their world well enough to be a trusted partner for the next decade.

The most successful fund managers don’t just raise capital – they attract capital by becoming the partners LPs actually want to work with. To do this, start by deeply understanding your LPs – and make sure your value proposition to them nails this.

(Read also part I: What’s your LP Value Proposition?)

The 2X GP Sprint accelerator has run three cohorts to date for emerging fund managers globally. The training materials has been used widely for emerging fund managers across programs and executive education programs.

Chris Rangen is a fund strategy advisor who has worked with 250+ emerging fund managers globally. He runs global VC Masterclasses and teaches at leading programs like IMD’s Venture Asset Management Program, led by Jim Pulcrano (Lausanne), and Newton Venture Program (London).

The work in the VC space is largely thanks to great clients, partners and most of all 250+ emerging fund managers around the world. A big thanks to Marc Penkala, Rick Rasmussen and Scott B. Newton for discussions around this topic. A shoutout to Holger Nils Pohl for helping all of us working visually, and Alexander Osterwalder for helping the world think about value propositions more clearly.

The LP Value Proposition Map and LP Stack training materials are available through the programs and Masterclasses and at strategytools.io.