CASE STUDY | VENTURE CAPITAL

Taking Venture Asset Education in Europe to the Next Level

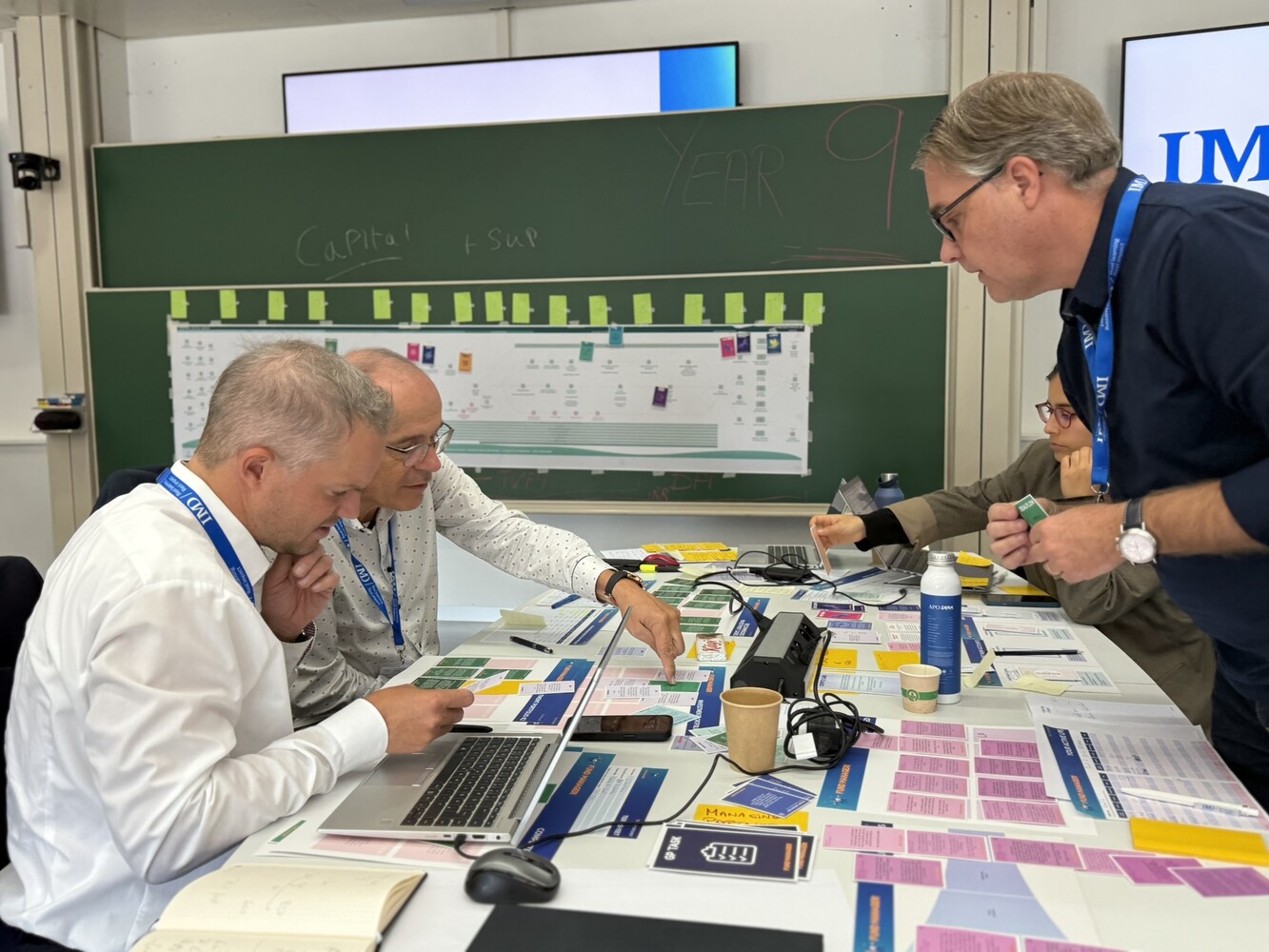

IMD Classroom, packed for the Venture Asset Management Program, September 2025

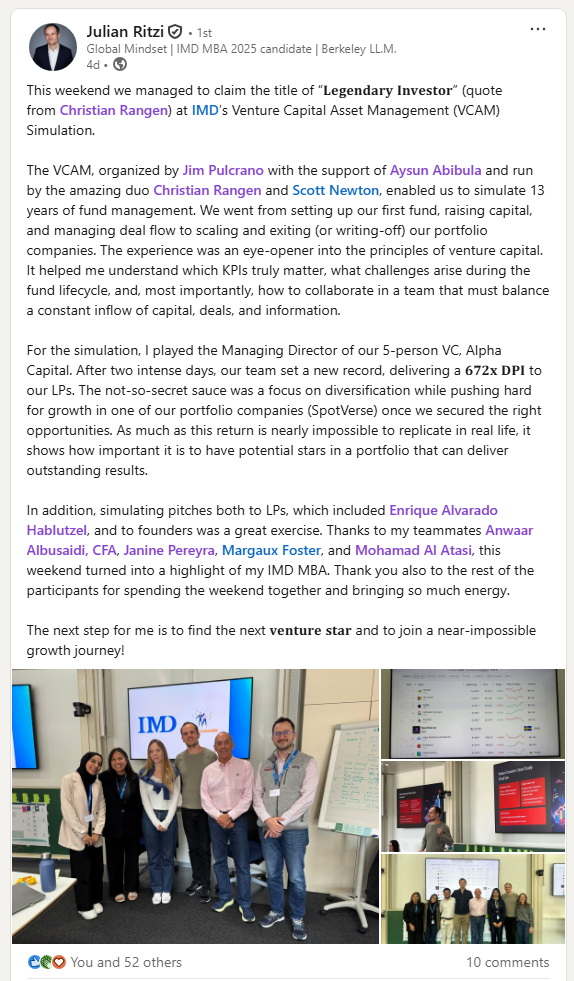

30 participants. 12 funds. 6 teams. 2 days. 1 stunning ‘legendary performance’.

This past weekend, a remarkable executive education cohort dove into all things venture financing at IMD Business School in Lausanne, Switzerland. The Venture Capital Asset Management Programme brought together participants from across the globe—Saudi Arabia, Brazil, Uruguay, Germany, South Africa, Philippines, Switzerland, Oman, Mexico, United States, and UK—to step into the shoes of a first-time fund team and start, build, scale, and lead a new venture capital firm.

Building, not just listening to, venture capital funds

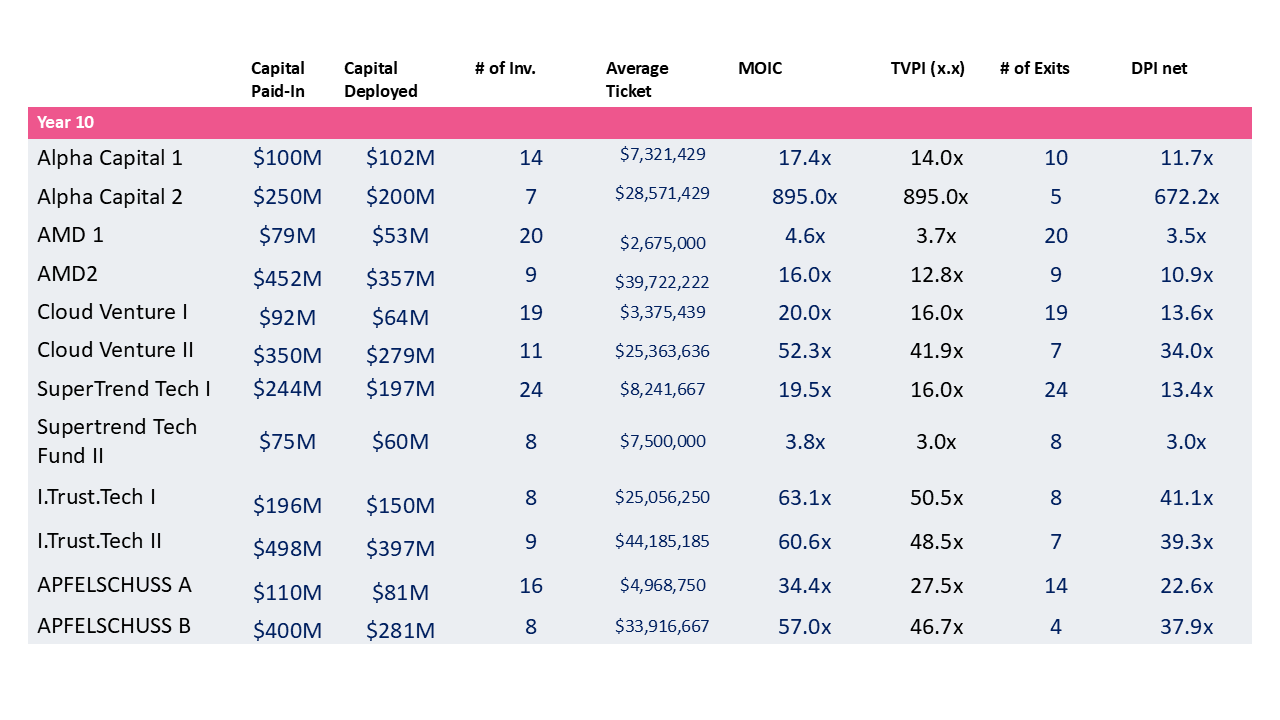

The numbers tell an extraordinary story: $2.2 billion deployed across 153 investments, with over 100 exit transactions. Fund performance ranged dramatically from respectable 3.0x and 3.5x returns to exceptional 10.9x multiples, culminating in a wildly impressive, extreme outlier of 672x net DPI. This record-breaking return was driven by a single Swedish AI-native music platform called SpotVerse, which reached IPO at a $2.2 trillion valuation—making it the 6th most valuable company in the world, just after Amazon and just before Meta.

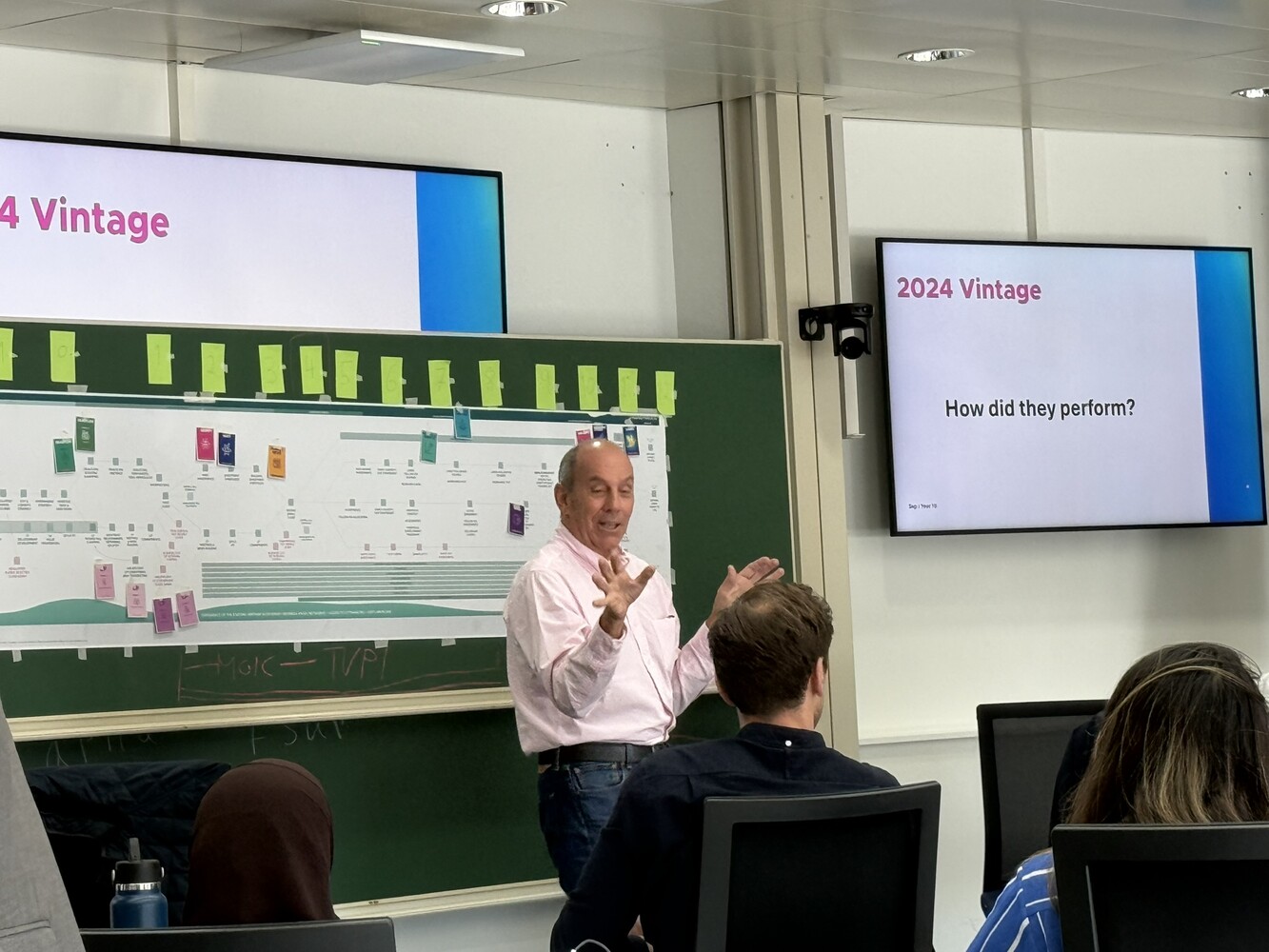

Final day at IMD’s VAM. Six teams are racing for outlier DPI. AI fueled investments are skewing portfolios to top quartile performance.

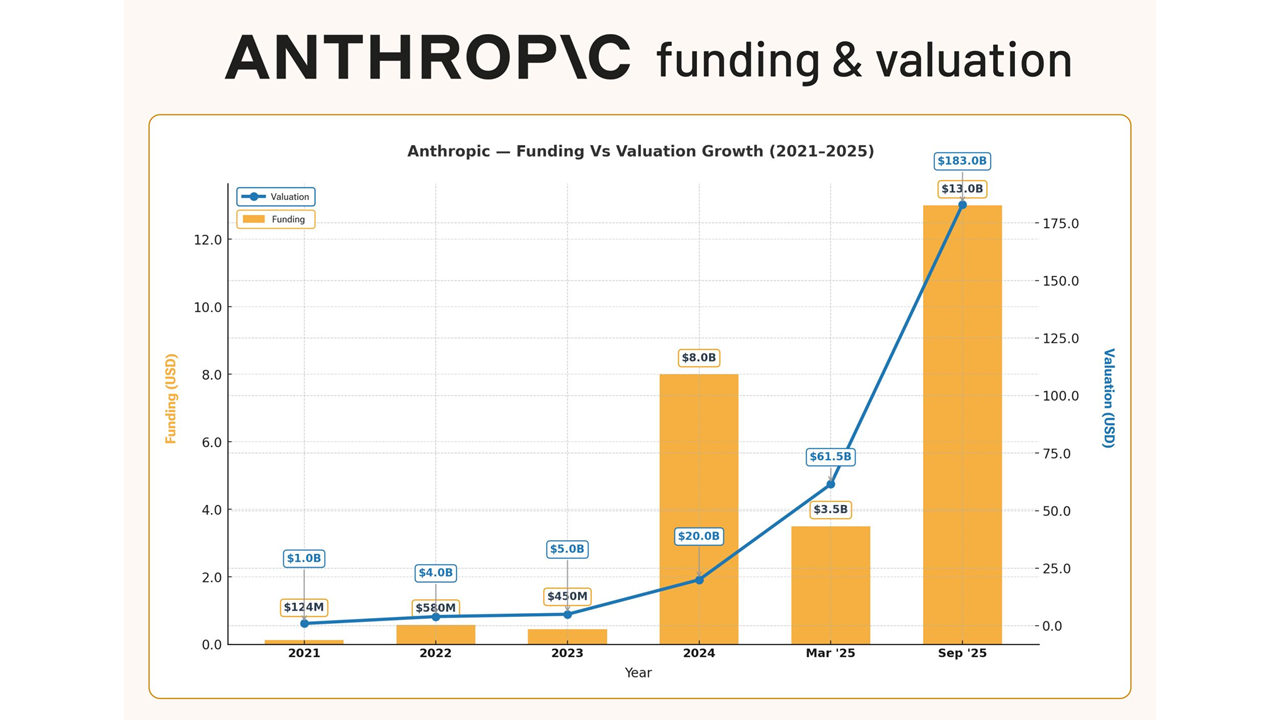

Improbable? Yes, 100%. But venture capital is a sport of outliers. The cohort studied the growth trajectories of real-world companies like Lovable, Anthropic, and OpenAI. As the venture ecosystem evolves, it’s only a question of time before we witness a zero-to-trillion startup, most likely an AI-native company with minimal headcount and explosive ARR growth.

The Challenge

Europe faces a critical venture capital gap. While the continent produces world-class entrepreneurs and groundbreaking innovation, it significantly lags behind the United States and Asia in venture capital deployment and fund formation. According to recent industry data, European VC funding represents less than one-fifth of US levels, despite having comparable GDP and talent pools.

The shortage isn’t just about capital—it’s about capability. Europe needs more venture capital firms, more venture funds, and critically, more skilled fund managers who understand the full lifecycle of venture investing. From raising capital from Limited Partners to sourcing deals, managing portfolios, navigating complex cap tables, negotiating term sheets, and ultimately delivering returns—these are skills that can’t be learned from textbooks alone.

The traditional path to becoming a VC investor is opaque and often inaccessible, typically requiring years of apprenticeship within established firms. This creates a bottleneck: as Europe strives to build a more robust venture ecosystem, there simply aren’t enough trained professionals to launch and manage the new funds the continent desperately needs. The question becomes: how do you accelerate the development of world-class fund managers without waiting a decade for them to learn on the job?

The second challenge

Beyond the shortage of skilled fund managers lies an equally critical challenge: mobilizing Europe’s substantial capital reserves into venture LP commitments. Despite sitting on trillions in institutional capital, European pension funds have been historically conservative, allocating far less to venture capital than their US counterparts. Recent regulatory reforms across the EU are beginning to shift this landscape, with countries like France and the Netherlands leading pension fund modernization efforts that increase alternative asset allocations.

Simultaneously, Europe’s extensive network of family offices—estimated to control over €1 trillion in assets—is increasingly viewing direct VC fund investments as essential portfolio diversification, moving beyond traditional wealth preservation into active venture participation.

Switzerland, in particular, has emerged as a testing ground for institutional VC engagement, with foundations traditionally focused on philanthropy now exploring venture capital as a tool for both financial returns and impact. Yet despite these encouraging signals, the gap persists: too much European capital remains on the sidelines, invested in US funds or trapped in low-yield traditional assets, while homegrown startups seek funding.

The challenge isn’t just creating more fund managers—it’s building the confidence, knowledge, and frameworks that turn Europe’s institutional capital holders into active, sophisticated Limited Partners in their own venture ecosystem.

The Solution

IMD Business School’s Venture Capital Asset Management (VCAM) Programme offers an innovative answer: experiential learning at warp speed.

Under the academic leadership of Jim Pulcrano and program coordination by Aysun Abibula, with visiting faculty contributions by Christian Rangen and Scott Newton, the program compresses years of venture capital learning into an intensive two-day classroom, and two-day simulation. Drawing on insights from industry leaders like Daniel Keiper-Knorr from Speedinvest, Michael Sidler of Red Alpine and Olivier Laplace of Vi Partners, participants don’t just observe venture capital—they live it.

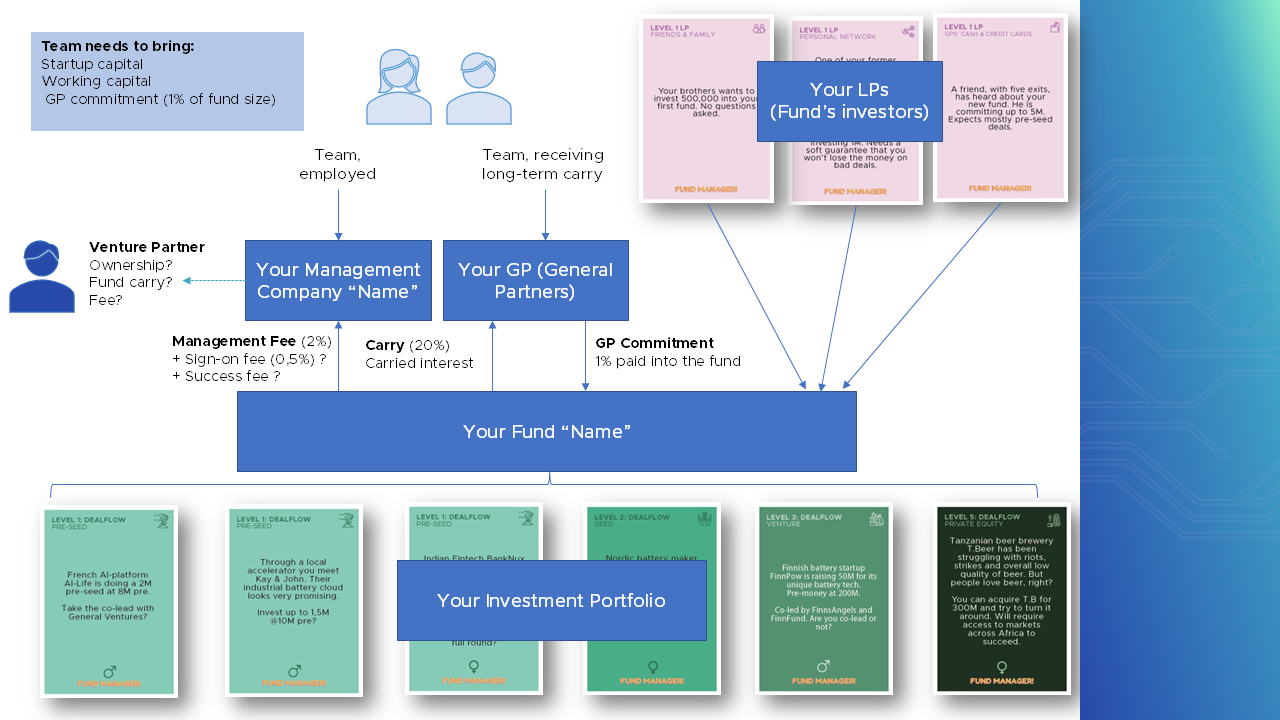

Early days, GP teams are just getting set up. Who wants to take on the Managing Partner role? Should we target 20M, 50M or maybe a 500M fund size? How much for follow-on and what kind of exit paths might we pursue?

How It Works

The VCAM program transforms participants into functioning venture capital teams within hours. Each team of 4-5 members takes on authentic roles—Managing Director, Investment Director, Deal Flow Analyst—and must navigate the complete 10-13 year lifecycle of a venture fund.

Day 1: Classroom discussions, in-person guest speakers and foundational knowledge

· The mechanics of a VC fund

· Why you might not want to invest directly into startups

· Art & Science of Valuations

· Understanding term sheets and shareholder agreements

· How ESG might be part of your investment decision

Day 2: Classroom discussions, in-person guest speakers

· How Pension Funds See VC

· Exit Planning & Exit Dynamics

· Understanding our investing biases

· How an entrepreneur sees VC

Day 3: from classroom to simulation: Foundation and First Moves

- Teams establish their investment thesis and fund strategy

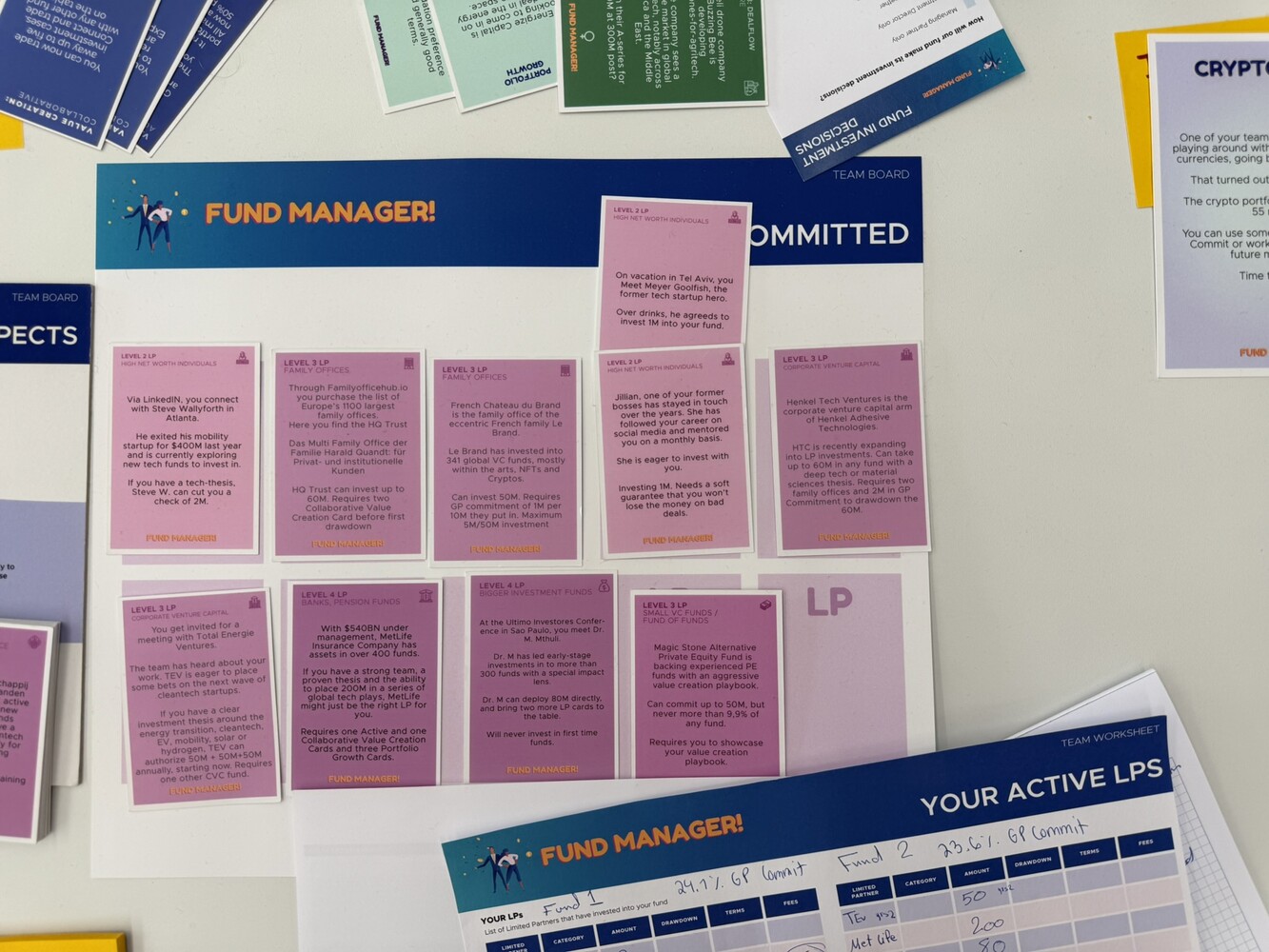

- Begin raising capital from sophisticated Limited Partners (played by experienced investors like Enrique Alvarado Hablutzel)

- Source and evaluate initial deal flow

- Make their first investments under pressure

- Watch as other teams land unicorns, creating immediate competitive dynamics

A simplified version of the GP-LP structure.

Early on, teams get into the LP hunt, trying to fund LPs that are a great fit for the strategy.

Day 4: Expanding the simulation: Scale and Survival

- Navigate market shocks and portfolio management challenges

- Make critical follow-on investment decisions

- Manage complex deal structures, dilution, convertibles, and drag-along rights

- Execute exit strategies—from modest acquisitions to billion-dollar IPOs

- Calculate and optimize MOIC, TVPI, and DPI metrics

- Pitch LPs for Fund II commitments based on Fund I performance

The simulation doesn’t coddle participants. They face real VC pressures: strategic dilemmas, high-stakes negotiations, write-offs, and the constant need to balance capital deployment, deal flow, and portfolio construction.

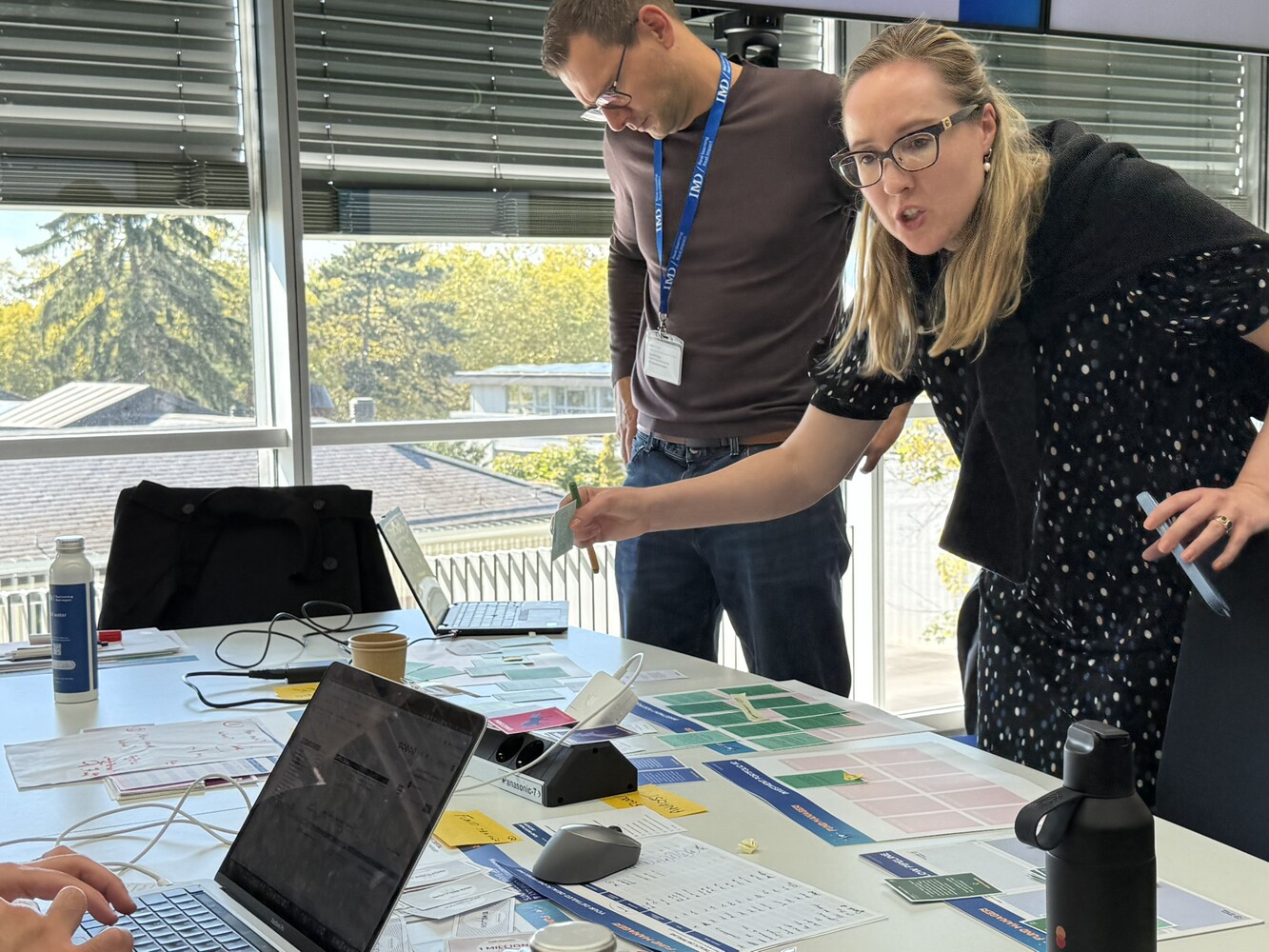

Fast paced VC deals closing in minutes. Deal flow analysts are racing to structure investment syndicate together.

As one participant noted, “It’s one thing to read about VC in books, but you only ‘get it’ under pressure.”

The Pedagogical Approach

What makes the program exceptional is its commitment to learning by doing. Participants aren’t passive observers; they’re active decision-makers facing the consequences of their choices in real-time. The competitive element—teams vying against each other with live leaderboards—adds intensity and engagement that mirrors real-world market dynamics.

The program also emphasizes collaborative learning across experience levels. By combining IMD MBA students with senior business professionals from VC firms, family offices, capital markets, and pension funds, the program creates a rich learning environment where energy meets experience. As the program director, Prof. Jim Pulcrano, noted: “What happens when you insert 9 IMD MBAs into a classroom with 21 investors? Magic happens and everyone improves their skills as venture capital investors.”

Back office, every team needs to keep its work flow flowing, avoid clutter and keeping the paperwork up to date. Not always easy.

Impact

The results speak louder than any curriculum description.

Quantitative Outcomes

Over the weekend, the six teams collectively:

- Managed 12 distinct venture funds

- Deployed $2.2 billion in capital

- Made 153 investment decisions

- Executed over 100 exit transactions

- Generated fund returns ranging from 0.4x to an astonishing 672x net DPI

Final day, year 10, leaderboard

The winning team, Alpha Capital 2, delivered a stunning 672x return to their Limited Partners—a performance that, while unlikely in reality, demonstrated deep understanding of portfolio construction, follow-on strategy, and the power law dynamics that define venture capital. Their success came from identifying and heavily backing SpotVerse, then supporting it through multiple funding rounds to a historic $2.2 trillion exit.

Qualitative Transformation

Beyond the numbers, participants experienced profound shifts in understanding:

Strategic Thinking: Teams learned to balance diversification with concentration, understanding when to double down on winners and when to cut losses. As Alpha Capital’s managing director reflected: “Our winning moves were playing to strengths, staying agile, going big and bold, and trusting our thesis.”

Practical Mastery: Concepts like DPI, MOIC, TVPI, LP, and GP moved from abstract acronyms to practical tools. Participants negotiated term sheets, managed cap tables, calculated dilution, and presented to sophisticated investors—skills that typically take years to develop.

Team Dynamics: The pressure-cooker environment revealed the importance of team composition, communication, and decision-making processes. Successful teams celebrated wins, adapted quickly to market changes, and ensured everyone was in the right role.

Realistic Perspective: Perhaps most valuably, participants gained honest insight into what venture capital really entails—the uncertainty, the pressure, the need for conviction amid ambiguity, and the rare but transformative power of outlier returns.

Reading about Anthropic’ s breakout valuation growth is one thing; trying to outpace it in the Fund Manager! is something entirely different.

Participant Testimonials

Intense, collaborative, fast-paced. How much GPs experience the program.

The impact is best captured in participants’ own words:

“Two days. One live, competitive IMD VCAM simulation. Ten-year fund lifecycle. The learning was incredible. We built an investment thesis, then faced real VC pressures: strategic dilemmas, market shocks, high-caliber LPs, complex deal structures, and even a few write-offs.” — Janine Pereyra

“In just 48 hours, we went from barely knowing what pre-money meant to negotiating term sheets and syndicating deals. It’s one thing to read about VC in books, but you only ‘get it’ under pressure.” — John Nicholas

“The best learning experience—budding unicorns all over! An actual magic learning process.” — Anna Ziajka

“Just wow… So much of what I’ve been picking up mostly piecemeal over the years really began to crystallize. My VC excitement is validated.” — Ashton Songer Ferguson

Multiple MBA participants described the program as a highlight—or even the highlight—of their MBA experience.

Broader Ecosystem Impact

The program’s impact extends beyond individual learning. By training cohorts of skilled fund managers, as well as giving LPs the insights they need, IMD is directly addressing Europe’s venture capital capability gap. Participants leave not just with knowledge, but with confidence, network connections, and practical experience that can accelerate their careers in venture capital or inform their work as entrepreneurs, corporate strategists, or limited partners.

As Prof. Pulcrano noted after watching teams compete: “Loved working with you. DPI, MOIC, LP, TVPI, GP are now part of your vocabulary. Congrats to all 6 teams.”

About IMD Venture Capital Asset Management Program

IMD’s Venture Capital Asset Management Program represents a pioneering approach to developing the next generation of venture capital leaders, both GPs and LPs. Located in Lausanne, Switzerland—at the heart of European innovation—IMD Business School has created a program that bridges the gap between academic theory and real-world practice.

The program is designed for:

- Investment professionals looking to deepen their VC expertise

- Corporate executives exploring venture investing or innovation strategies

- Entrepreneurs wanting to understand the investor perspective

- Family office professionals building direct investment capabilities

- Pension fund managers investing in the next generation of Europe’s VC funds

- And supported by MBA students, the number-crunching CFOs and Fund Managers seeking to enter venture capital or entrepreneurship

Program Philosophy

The VCAM approach rests on several core principles:

Experiential Over Theoretical: Participants learn by talking with practicing professionals, managing actual fund simulations, making real decisions under time pressure, and experiencing the consequences of their choices.

Collaborative Competition: Teams compete against each other while learning from shared experiences, creating an environment that mirrors real venture capital markets.

Expert Guidance: Led by academic faculty with deep industry connections and facilitated by experienced practitioners, participants receive both theoretical frameworks and practical insights.

Global Perspective: By bringing together diverse participants from multiple continents and industries, the program reflects the increasingly global nature of venture capital.

Looking Forward

IMD continues to evolve and expand the Venture Asset Management Program. The next cohort is scheduled for May 2026, promising another intensive four days of learning, competition, and transformation.

As Europe works to build a venture ecosystem that matches its entrepreneurial potential, programs like IMD’s VCAM are essential infrastructure—not just teaching people about venture capital, but creating the skilled fund managers who will launch and lead the next generation of European venture firms.

The weekend’s results prove what’s possible when you combine rigorous academic foundations with hands-on practice, competitive dynamics with collaborative learning, and theoretical knowledge with real-world pressure. From 3x to 672x, from first-time fund managers to “legendary investors,” the IMD VCAM experience demonstrates that with the right approach, you can dramatically accelerate the development of world-class venture capital talent.

Europe needs more venture capital firms and more venture funds. IMD is leading the way in creating the fund managers who will build them.

Interested in participating in the next IMD Venture Capital Asset Management Program? Visit IMD VAM to learn more.

get in touch

Talk to Us

Get in touch to find out more about our masterclasses and programs and how you can bring them to your organisation.