Are you heading into one of our upcoming Scale Up MENA! Masterclasses? In that case, you might want to explore the wonders of cap table management first. Think about this as a soft warm-up exercise.

Cap tables matter

Cap tables are the backbone of any successful startup scaling into a long-term successful winner. But, along the way, founders are likely to raise 5 – 15 rounds of financing, including SAFE, CLA, Equity, Debt, RVB and Project financing. How to keep track of it all? Your cap table.

Try your skills

Leading up to the Scale Up MENA! masterclasses, we have set up a super simple, yet complex exercise for anyone to test their cap table skills.

Meet MedAssist

Here is MedAssist, a fictive case company based in MENA. Your job, guide them through five round of early-stage financing. Make the investments. Update the cap table as needed. Below are 15 early-stage mini-term sheets, based on terms you might likely see at each stage. These are based on market standards in the region.

For any requirements, just make the reasonable assumption that you have these requirements in place as you proceed. For revenue and ARR, the number is listed as you progress below.

For initial set up of the cap table. Assume you have five founders, each owning 20% each. A total of 100.000 shares, at $5 per share, equal split amongst the team. There is no vesting in place and no ESOP in place – yet.

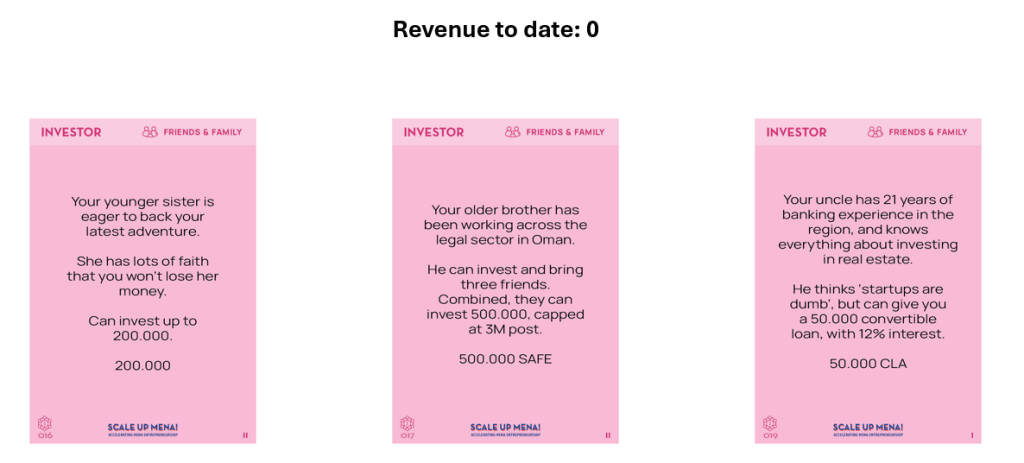

Round 1: Idea round (friends and family)

First round has three early family members interested. Which one or ones would you choose? What would be the preferred investment instrument? At this stage, MedAssist is pre-revenue.

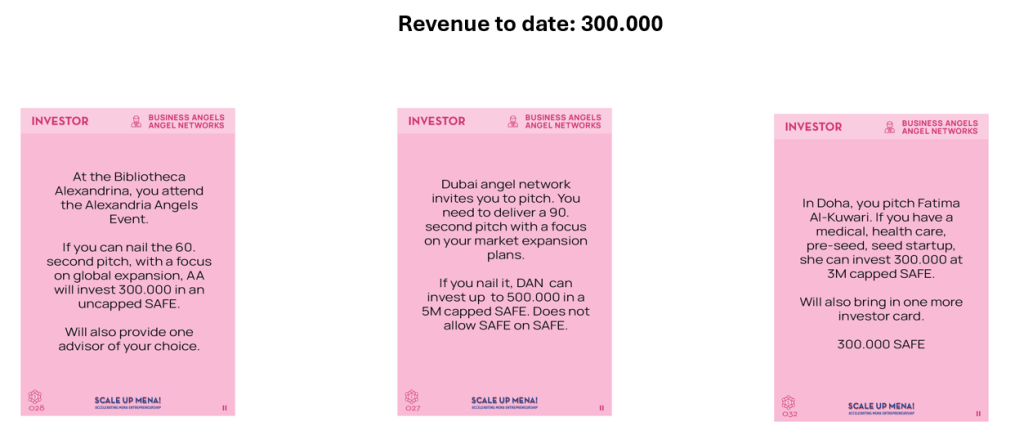

Round 2: Pre-seed round (business angels)

Months go by, and angel investors are lining up for the pre-seed round. With 300.000 in early revenue, the momentum is growing. Would Alex Angels, DAN or Fatima be a better fit? or maybe all of them?

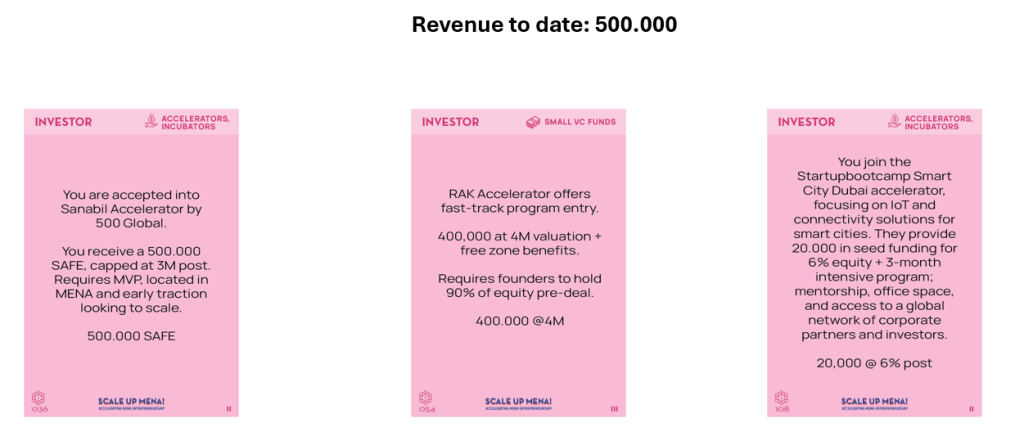

Round 3: Seed round (accelerators)

Post angels, local accelerators are next. Sanabil 500, RAK or Startup Bootcamp are all great programs. Yet, in our example, also offering very different terms. Who would you go with?

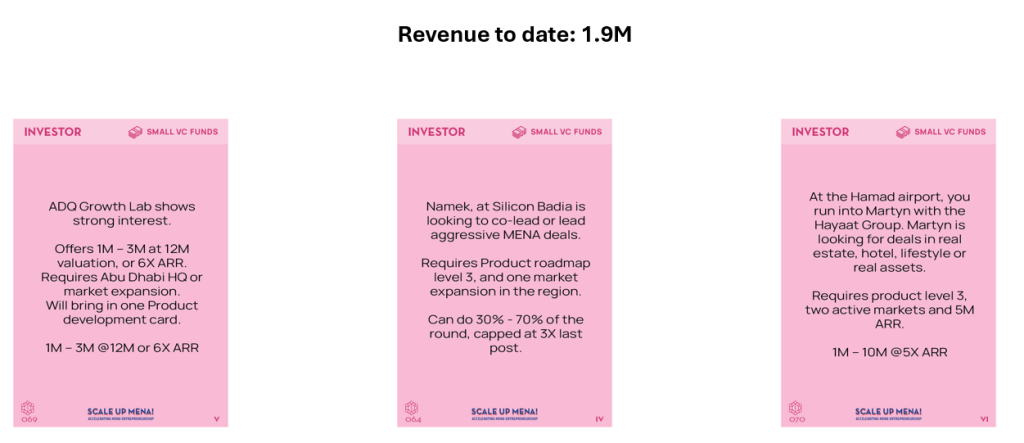

Round 4: Seed+ round (early VCs)

Revenue tips the magic $1M mark. Things are looking up. VCs come around for early coffee. Note, they all want various forms of market traction and progress. Let’s just assume you already have the Dubai Market Expansion card here.

Round 5: Small Series A (VCs)

Ah, our final round, a small Series A. With revenue at $1.9M, we are above the classic $1M mark, but still below the new, $3M ARR milestone for a “real Series A”. With strong interest now from ADQ, SB and HG, who would you choose to work with here?

Cap table management

Ok, you have the story, you have the data. Now, can you run up the cap table?

Assume five founders, 20.000 shares each, entry at 5 per share. You take it from there. Good luck – and post your cap table in the comment.

Welcome to Scale Up MENA! Masterclass

If you enjoyed – and have completed – our little MedAssist task, you should be ready for the upcoming Scale Up MENA! Masterclass. Globally, more than 4.000 founders, investors, VCs, family offices, sovereign wealth fund investment officers, accelerators, bankers, board members, angel investors, climate funds, consulting companies, foundations, innovation agencies, ministries, students and educators have all built their founder skills and cap table skills with Scale Up!

Now, we are excited to launch the Scale Up MENA! Masterclass, 100% tuned into the realities of fundraising in the Middle East and North Africa. Based on 12+ months of research and 15+ years with early-stage investment experience, Scale Up MENA! Masterclass lets you build out your fundraising skills, cap table skills and overall scale up leadership skills in just hours.

Join us for the upcoming Masterclasses in Dubai and Egypt, read more about Scale Up MENA! or get in touch today, [email protected]