In most venture capital ecosystems, the lack of exits and liquidity events form a massive challenge for LPs, GPs, founders, employees and the next generation of entrepreneurs alike. Yet, we see investors, like Silverback Holdings, being able to generate liquidity events along the journey. In our work with investment firms we have been able to build more exit skills, exit capacity and successful exit transactions. The secret? Using the Exit Journey Canvas.

In this post, we invited key ecosystem builders like David van Dijk and Anthony William Catt to share their invaluable views on exits and liquidity in the market. Grab the canvas. Join the conversation and good luck on getting more strategic exits and liquidity in your portfolio.

Chris Rangen & Claude.ai, with key contributions from David van Dijk & Anthony William Catt

Preface: How Ecosystem Scales

For the startup ecosystem to thrive, we need to accelerate exits and unlock liquidity. Without visible success stories, confidence falters and capital slows. Liquidity proves that the system works.

Major exits like Paystack’s acquisition by Stripe and Expensya’s sale to Medius demonstrate that startups from Africa and other emerging markets can achieve high-value outcomes. These events not only attract global investor attention but also validate the viability of the ecosystem.

Just as important is what happens after the exit. In Nigeria, members of the “Paystack Mafia”—former employees and early backers—have become active investors and mentors, supporting a wave of new startups. In Tunisia, Expensya’s exit generated over $10 million in employee payouts, instantly creating a new pool of angel investors.

This cycle of capital and talent reinvestment builds momentum. It’s how ecosystems scale—from early wins to sustained growth.

– David van Dijk, Team Lead Boost Africa TA, Co-Lead African Angel Academy.

Why, Exit Journey?

For many VC firms, especially those managing their first or second funds, the transition from “investing in great companies” to “creating liquidity events” represents a fundamental shift in mindset and capability.

Over the past two years, we have worked with investment firms across Europe, MENA, Africa, APAC and North America on creating more exits.

One Of Our ‘Secret Tools’? The Exit Journey Canvas.

What Is The Exit Journey Canvas?

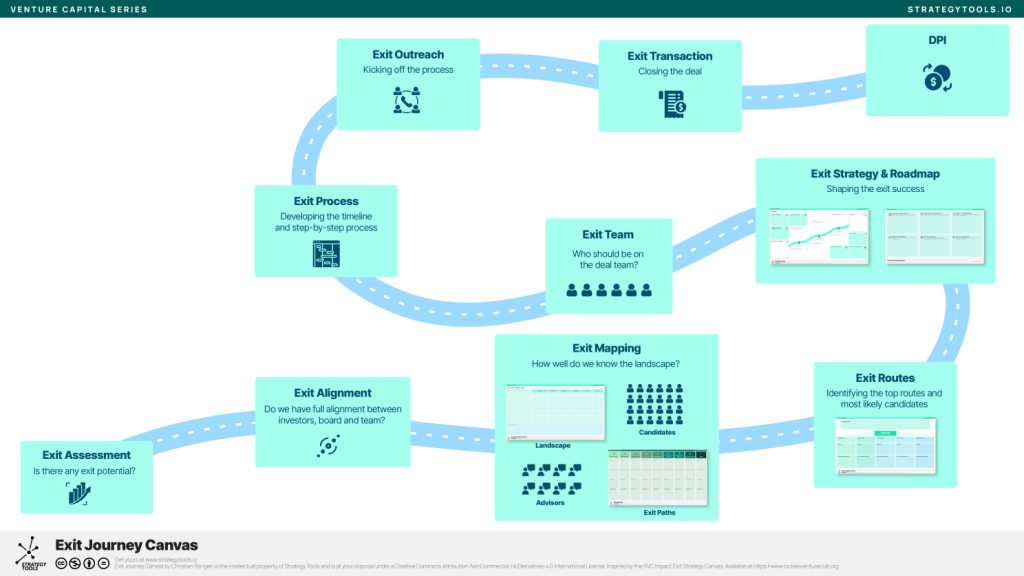

The Exit Journey Canvas provides a structured approach to navigate the shift from investments to generating exits at scale. The canvas is a ten-step, visual workflow for how fund managers, from Senior partners to associates, can bring a structured workflow to exits and liquidity in the existing investment portfolio.

It is a canvas perfectly suited for exit teams, Head of DPI or anyone tasked with creating exits and liquidity in an existing portfolio. Note, the Exit Journey Canvas is not designed for working on exit paths pre-investment. For that purpose we recommend the GP Exit Canvas.

The Exit Journey Canvas:

- Exit Assessment How do we rank our Portfolio companies on exit readiness and exit maturity? Is there any exit, liquidity or even partial liquidity potential in our companies? Do we have any specific companies we should take on the Exit Journey?

- Exit alignment Do we have full alignment on liquidity and exit between the other investors, the board, founders and management team?

- Exit mapping How well do we know the landscape for exits and liquidity?

- Exit routes Have we mapped out the top routes and most likely candidates?

- Exit strategy & roadmap Have we created the gameplan and roadmap to succeed?

- Exit team Who should be on the deal team?

- Exit process Do we have a timeline and clear, step-by-step process?

- Exit outreach How do we lead the a successful exit outreach and competitive process?

- Exit transaction Do we have the experience, skills and team to close a successful transaction?

- DPI (Distributions to our LPs) Are we ready to start paying out some distributions to our Limited Partners?

The Exit Canvas, in connection with the five other deep dive canvases, helps any team establish a step-by-step process to radically increase the chances of a successful liquidity event, and ultimately LP returns.

Want the Exit Journey Toolkit? Download here.

The Challenge Of Portfolio Exits

Consider the typical mid-fund scenario: you’re seven years into your fund lifecycle, your best investments are showing strong traction, but exits remain elusive. Your LPs are asking about liquidity timelines, founders are focused on growth over exit preparation, and potential acquirers aren’t yet taking serious interest. This is where the Exit Journey Canvas becomes invaluable.

Unlike the GP Exit Canvas (read here) , which embeds exit thinking into investment decisions, the Exit Journey is designed for active portfolio management. It provides a systematic approach to evaluate, prepare, and execute exits for companies already in your portfolio.

Canvas In Action: Kilimanjaro Ventures Fund III

To illustrate the Exit Journey in practice, let’s follow Kilimanjaro Ventures’ evolution. Now managing their third fund—a $100M vehicle launched in 2020—they’ve become one of East Africa’s most successful venture capital firms. Their proven exit track record from Funds I and II has attracted larger LPs and enabled bigger check sizes, typically $3-8M investments in Series A and B rounds across Africa. Across the portfolio, KV III is now regularly updating the portfolio ranking by exit readiness (management and process readiness) and exit maturity (good return potential).

By Fund III, Kilimanjaro has expanded beyond East Africa into West Africa, making their largest investment to date: $6M into Lagos-based RideConnect, a pan-African mobility platform competing with traditional ride-hailing services.

Let’s walk through each step of the Exit Journey using RideConnect and other Fund III portfolio companies as examples.

1. Exit Assessment: Identifying Exit Potential

The Canvas: Systematically evaluate each portfolio company’s exit readiness and potential, creating a pipeline of exit candidates.

Kilimanjaro’s Approach: Five years into Fund III, the team conducts their quarterly exit assessment across 22 portfolio companies using their refined scorecard system. They evaluate companies across six dimensions: financial performance, market position, strategic value, management quality, exit market conditions, and competitive differentiation.

Their Q3 2026 assessment reveals distinct categories:

Immediate Exit Potential: RideConnect (mobility) leads with $12M ARR, operations in 6 African countries, 2.5 million active users, and increasing strategic buyer interest as global mobility companies seek African expansion.

12-Month Exit Window: PayFlow (B2B payments) shows strong unit economics but needs to achieve $5M ARR threshold that strategic buyers typically require for serious consideration.

24+ Month Timeline: AgriLogistics (supply chain) has excellent technology and partnerships but requires scale across 10+ countries before becoming attractive to international buyers.

The assessment prioritizes RideConnect based on multiple factors: proven product-market fit across diverse African markets, strong unit economics in major cities, and a competitive landscape where international players are actively acquiring local champions.

2. Exit Alignment: Building Internal Consensus

The Canvas: Ensure full alignment between investors, board members, and founding teams on exit strategy and timeline.

Kilimanjaro’s Approach: For RideConnect, their highest-priority exit candidate, Kilimanjaro schedules alignment sessions with CEO A. Okafore and the founding team. Initial discussions reveal interesting dynamics: the founders are excited about exit possibilities but want to ensure any acquisition preserves their vision for African mobility innovation.

Through structured workshops, they establish shared priorities:

● Achieve minimum 8x return for all investors (targeting $100M+ exit value)

● Maintain operational independence for African markets

● Preserve employment for RideConnect’s 400+ person team

● Complete transaction within 18 months to align with fund timeline

The founding team agrees to begin exit preparation while continuing aggressive expansion into Ghana and Senegal. Board consensus emerges around positioning RideConnect as the leading African mobility platform rather than just a Nigerian success story.

For PayFlow, alignment sessions reveal the founding team prefers to raise additional growth capital rather than pursue exit. Kilimanjaro agrees to support a bridge round while keeping exit optionality open for 2027.

3. Exit Mapping: Understanding The Landscape

The Canvas: Comprehensively map potential acquirers, market conditions, and competitive dynamics that will influence exit opportunities. To assist teams here, we also recommend using the Exit Landscape Map and GP Exit Paths to assist the quality of research and market mapping at stage. These tools are a part of the GP’s toolbox and can be brought in to give a more analytical way of working for the GP team.

Using the GP Exit Paths, the KV team may realize the best, or most likely exit paths are going to be strategic M&A, PE, Partial Secondaries and IPO as a far-away, unlikely option.

Kilimanjaro’s Approach: For RideConnect, their mapping process identifies four categories of potential acquirers in a possible M&A deal.

Global Mobility Giants: Uber, Bolt, and DiDi are all expanding African presence. Recent transactions suggest 6-10x revenue multiples for profitable mobility companies with strong market positions.

Regional Tech Champions: Jumia and Interswitch have both signaled interest in mobility investments. These buyers value local market knowledge and regulatory relationships.

Automotive Strategic Buyers: Volkswagen, Toyota, and local partners like Stallion Group seek African mobility data and customer relationships for future automotive strategies.

Financial Services Integration: Banks like Access Bank and fintech companies see mobility platforms as customer acquisition channels for financial services.

The mapping reveals critical timing insights: Uber has recently appointed a new Africa head with aggressive expansion mandates. Bolt raised $700M specifically for emerging market expansion. DiDi is exploring African entry after successful Latin American expansion.

Competitive analysis shows that Uber’s African operations remain subscale compared to their global footprint, creating acquisition motivation. Bolt’s recent Lagos entry validates the market but also creates urgency for consolidation.

Partial secondaries: through this initial mapping exercise, existing co-investors indicate they might be willing to take half of Kilimanjaro’s shares, at a ‘reasonable’ discount.While not a priority at this point, secondaries should never be disregarded and gets stored away as an option for the team at Kilimanjaro Ventures.

4. Exit Routes: Prioritizing Pathways

The Canvas: Identify and prioritize the most promising exit routes based on company readiness, market conditions, and strategic fit. To dig deeper, we frequently suggest using the Exit Routes Canvas at this stage. The Exit Routes canvas is a superb tool to map out strategic groups and start listing specific buyers and what would make this deal relevant to them. Having used the Exit Routes Canvas is 100’s of Masterclasses and Workshops, this is one of the tools people tend to call “extremely useful”.

Kilimanjaro’s Approach: Based on mapping analysis, they prioritize RideConnect’s exit routes:

Primary Route: Strategic acquisition by Uber for African expansion, targeting Q4 2027. This offers highest potential valuation, proven integration playbook, and global scaling opportunities.

Secondary Route: Acquisition by Bolt to defend their African expansion strategy, potentially faster timeline but lower valuation multiples.

Tertiary Route: Sale to regional technology champion (Jumia or Interswitch) for ecosystem integration, good cultural fit but limited international scaling.

They consciously deprioritize automotive strategic buyers due to longer integration timelines and uncertain synergy realization.

For each route, they develop specific preparation requirements. The Uber route requires demonstrating regulatory compliance across all markets, driver/rider retention metrics, and competitive differentiation. The Bolt route needs detailed competitive intelligence and market share documentation. Regional buyers want comprehensive African expansion plans and partnership possibilities.

5. Exit Strategy & Roadmap: Building The Plan

The Canvas: Develop detailed roadmaps for preparing portfolio companies for exit, including milestones, timelines, and resource requirements. Two canvases serve as great digging deeper tools here; the Exit Strategy Canvas (inspired by the book, Exit Path), and Exit Roadmap. These tools are designed to be used by the project team, in collaboration with management, board and key stakeholders.

Kilimanjaro’s Approach: For RideConnect’s primary exit route (Uber acquisition), they create a 12-month preparation roadmap:

Months 1-3: Complete comprehensive financial audit across all operating countries, compile regulatory compliance documentation, and standardize reporting across markets. Kilimanjaro connects RideConnect with PwC for multi-country audit coordination.

Months 4-6: Develop detailed competitive analysis showing market leadership positions, compile driver and rider satisfaction data, and document technology infrastructure scalability. Engage with McKinsey for strategic positioning analysis.

Months 7-9: Prepare integration documentation showing operational similarities with Uber’s platform, complete technical due diligence preparation, and develop management presentation materials for buyer meetings.

Months 10-12: Finalize expansion into Ghana and Senegal to demonstrate continued growth momentum, compile customer reference testimonials, and prepare detailed financial projections for combined entity scenarios.

Throughout this period, RideConnect continues aggressive market expansion while building exit readiness. Kilimanjaro provides dedicated project management support and covers all external advisor costs as portfolio support.

6. Exit Team: Assembling The Right Deal Team

The Canvas: Build a dedicated team, combining portfolio company management, VC firm expertise, and external advisors to execute exit processes. Frequently, a financial advisor and legal advisor would be involved here. For smaller deals, or secondary transactions that might not always be the case.

Kilimanjaro’s Approach: For RideConnect, they assemble a seven-person exit team reflecting the complexity and scale of the potential transaction:

From RideConnect: CEO Okafore leads strategic discussions and buyer relationships. CFO T.. Adeleke manages financial documentation and due diligence coordination. CTO D. Okwu handles technical integration discussions.

From Kilimanjaro: Managing Partner K.. Mwangi oversees overall process and leverages relationships with global mobility industry. Principal A. Kiprotich manages day-to-day coordination and timeline execution.

External Advisors: Investment banking team from Frontier Growth Capital Advisors provides transaction expertise and international buyer access. Legal counsel from Temple Law Partners handles multi-jurisdictional transaction structuring.

The team meets weekly during preparation phase and daily during active negotiations. Each member has clearly defined responsibilities and escalation authority for rapid decision-making.

For smaller portfolio exits, including secondaries, Kilimanjaro uses streamlined three-person teams, but RideConnect’s scale and complexity justify the expanded structure.

7. Exit Process: Managing The Transaction

The Canvas: Execute systematic process for managing buyer outreach, due diligence, and negotiations while maintaining business operations.

Kilimanjaro’s Approach: When RideConnect achieves exit readiness in Q2 2027, they plan a structured process:

Weeks 1-3: Initial outreach to six target buyers through warm introductions. Mwangi will leverage her expanding global network to arrange conversations with Uber’s Africa strategy team and Bolt’s expansion executives.

Weeks 4-8: Management presentations to four interested buyers. RideConnect’s strong metrics (40% market share in Nigeria, profitability in Lagos and Abuja, 25% month-over-month growth in new markets) is expected to generate significant buyer interest.

Weeks 9-16: Due diligence process with three serious buyers (Uber, Bolt, and Jumia). The exit team is prepared to manage comprehensive data room setup across six countries, coordinate management interviews in multiple time zones, and respond to detailed technical and regulatory questions while ensuring RideConnect’s operations continue seamless expansion.

Weeks 17-20: Letter of intent negotiations. Discussions expected to cover strategic synergies including driver training programs, technology platform integration, and African market growth potential that might increase valuation significantly above initial expectations.

Throughout the process, Kilimanjaro is prepared to maintain transparent communication with RideConnect’s management and provide regular updates to their LPs on transaction progress and portfolio impact. The plan, the timeline and process is now ready to launch.

8. Exit Outreach: Activating Buyer Network

The Canvas: Systematically reach out to potential acquirers through warm introductions, industry connections, and strategic relationships.

Kilimanjaro’s Approach: Drawing on their expanded network from three successful funds, Kilimanjaro leverages multiple relationship paths:

Global VC Network: Their LP relationship with IFC connects them directly to Uber’s corporate development team through mutual portfolio connections.

Industry Conferences: At the Africa Tech Summit in Kigali, Mwangi arranges private meetings between RideConnect’s CEO and executives from three potential acquirers.

Advisory Relationships: Their strategic advisor, former Jumia executive N. Hodara, facilitates warm introductions to both Bolt and current Jumia leadership.

Portfolio Synergies: Their fintech portfolio company PayFlow has existing partnership with Interswitch, creating introduction path to their corporate venture arm.

Investment Banking Network: Frontier Growth Capital Advisors leverages relationships with international clients to arrange strategic discussions with DiDi and other global mobility companies.

Each outreach approach is carefully customized. Conversations with Uber emphasize African market expertise and regulatory navigation. Bolt discussions focus on competitive differentiation and market share protection. Regional buyers hear about ecosystem integration and cross-selling opportunities.

The key success factor is activating multiple high-quality relationship paths simultaneously while maintaining process confidentiality and buyer competitiveness.

9. Exit Transaction: Closing The Deal

The Canvas: Manage final negotiations, due diligence, and closing process while protecting both investor and founder interests.

Kilimanjaro’s Approach: When Uber emerges as the preferred buyer for RideConnect at a $600M valuation, the transaction process intensifies significantly:

Legal Documentation: Temple Law Partners leads purchase agreement negotiations across six jurisdictions, drawing on their experience with previous Kilimanjaro cross-border exits to navigate complex regulatory requirements.

Technical Integration Planning: Uber’s technical team conducts extensive API integration testing and driver platform compatibility analysis. RideConnect’s technical documentation prepared during the roadmap phase proves invaluable for accelerating this complex process.

Regulatory Approval Coordination: The transaction requires regulatory approvals in Nigeria, Kenya, Uganda, Ghana, Senegal, and Tanzania. Kilimanjaro coordinates with local legal counsel in each market to manage parallel approval processes.

Founder and Team Protection: Negotiations include employment agreements for RideConnect’s leadership team, equity retention in the combined entity, and operational independence guarantees that preserve the company’s African market focus and innovation culture.

Multi-Investor Coordination: Kilimanjaro coordinates with RideConnect’s other investors (including Series A lead TLcom Capital and strategic investor MTN Ventures) to ensure aligned negotiating positions and efficient documentation execution.

The transaction closes in 22 weeks from initial serious discussions, generating a 10.4x return for Kilimanjaro and establishing RideConnect’s founders as key leaders in Uber’s African expansion strategy.

10. DPI (Distributions To Paid-In Capital): Returning Capital To LPs

The Canvas: Efficiently process distributions while managing tax implications, LP communications, and fund performance reporting. Ultimately, your LPs will want their capital back – with proceeds; and on the back of a great exit event, there should be a timeline to pay out to LPs.

Kilimanjaro’s Approach: The RideConnect exit generates $62M in proceeds for Kilimanjaro’s $6M investment. The distribution process involves several strategic considerations:

LP Communication Strategy: Before closing, Kilimanjaro sends comprehensive transaction analysis to LPs explaining the strategic rationale, competitive process, and return implications. They host dedicated LP webinar featuring RideConnect’s CEO discussing the African mobility market opportunity and Uber’s integration plans.

Distribution Timing Optimization: They coordinate with fund administrators across multiple jurisdictions to process distributions within 45 days of closing, providing LPs with detailed tax documentation for US, European, and African tax reporting requirements.

Fund Performance Impact: The exit, the third in Fund III, moves Fund III’s DPI from 0.2x to 0,8x, demonstrating concrete progress toward the fund’s 3.5x net return target and validating their expansion strategy into larger, pan-African investments.

Strategic LP Engagement: Several institutional LPs express strong interest in increasing commitments to Kilimanjaro’s upcoming Fund IV, with the RideConnect exit serving as a compelling case study for their ability to execute exits at significant scale.

Market Positioning: The successful exit to a global strategic buyer enhances Kilimanjaro’s reputation for executing international transactions, attracting attention from global corporates seeking African market entry partners.

Portfolio-Wide Application

Beyond the RideConnect success, Kilimanjaro applies the Exit Journey Canvas systematically across their Fund III portfolio:

PayFlow leverages their exit preparation to attract a strategic investment from Visa at a $40M valuation, providing partial liquidity for early investors while maintaining growth trajectory. For Kilimanjaro Ventures, a good opportunity to take 35% of their equity value off the table.

AgriLogistics uses the Canvas to identify key gaps in the exit thinking early, accelerating their multi-country expansion and positioning for acquisition by a global supply chain company in 2028.

HealthTech Ghana completes a secondary sale of the full equity position to a healthcare-focused growth fund, providing 4.2x returns to the fund. Two additional portfolio companies complete strategic acquisitions using refined processes from the RideConnect experience, with average exit multiples 25% higher than comparable transactions lacking systematic preparation. Three partial secondaries based on the thorough exit preparedness, Kilimanjaro Ventures is able to secure partial sales to new or existing investors in the market, proving a stand-out exit and liquidity skill.

Key Success Factors

The Exit Journey canvas’ effectiveness stems from addressing three critical challenges of portfolio exits at scale:

Systematic Over Opportunistic: Rather than waiting for buyers to discover portfolio companies, working on the canvas creates proactive exit processes that generate multiple options and competitive dynamics.

Preparation Drives Premium Valuations: Companies that systematically prepare for exits consistently achieve higher valuations and faster transaction timelines. RideConnect’s 10.4x return reflects both strong business performance and excellent exit execution.

Portfolio-Level Network Effects: By applying a strong exit discipline across multiple portfolio companies simultaneously, VCs create ecosystem momentum that attracts buyer attention to their entire portfolio and enhances their reputation for exit execution excellence.

Implementation Guidelines For Scale

For VC firms implementing the Exit Journey Canvas across larger portfolios:

Segment Portfolio by Exit Timeline: Apply different levels of exit focus based on company maturity and fund lifecycle requirements. Not every portfolio company needs immediate exit preparation.

Build Specialized Team Capabilities: At Fund III scale, dedicate specific team members to exit process management, international transaction coordination, and strategic buyer relationship development. These team members are Exit Team, Head of DPI or Chief Exit Officer (not familiar with the role of the Chief Exit Officer? Check out our favourite CEO in MENA, Rabih I. Khoury or how VC firms like Speedinvest think differently about paths to liquidity).

Invest in Infrastructure: Budget significantly for external advisors, legal coordination across multiple jurisdictions, and technical due diligence preparation. These investments compound across multiple transactions.

Maintain Operational Excellence: Ensure exit preparation enhances rather than distracts from business performance. The best exits come from companies demonstrating accelerating growth throughout the exit process.

Develop LP Communication Sophistication: Regular updates on exit pipeline development, competitive landscape analysis, and strategic buyer relationship building create LP confidence that supports larger fund sizes and better terms.

The Compound Effect At Scale

The most successful VC firms treat the Exit Journey not as a one-time process but as a core competency that improves with each transaction and compounds across fund generations.

Kilimanjaro Ventures’ success with RideConnect creates multiple strategic advantages: enhanced relationships with global strategic buyers, demonstrated capability for complex international transactions, validated processes for future exits at scale, and compelling case studies for Fund IV fundraising at $300M+ target size.

By systematically applying the Exit Journey Canvas across their portfolio, Kilimanjaro transforms from a regional fund that “hopes for exits” to an international-caliber firm that “engineers exits.” This transformation becomes a sustainable competitive advantage that drives superior returns for LPs, attracts higher-quality deal flow, and enables access to larger, more strategic investment opportunities.

The Exit Journey Canvas recognizes that in venture capital, building great companies is the foundation, but creating valuable exits requires sophisticated thinking, careful preparation, and disciplined execution. For VC firms ready to operate at international scale, the Canvas provides a proven roadmap for generating the liquidity that sophisticated LPs demand and reward with larger commitments and better fund terms.

Ecosystem Expert Opinion: Anthony William Catt

IPO Readiness & Public Market Optionality

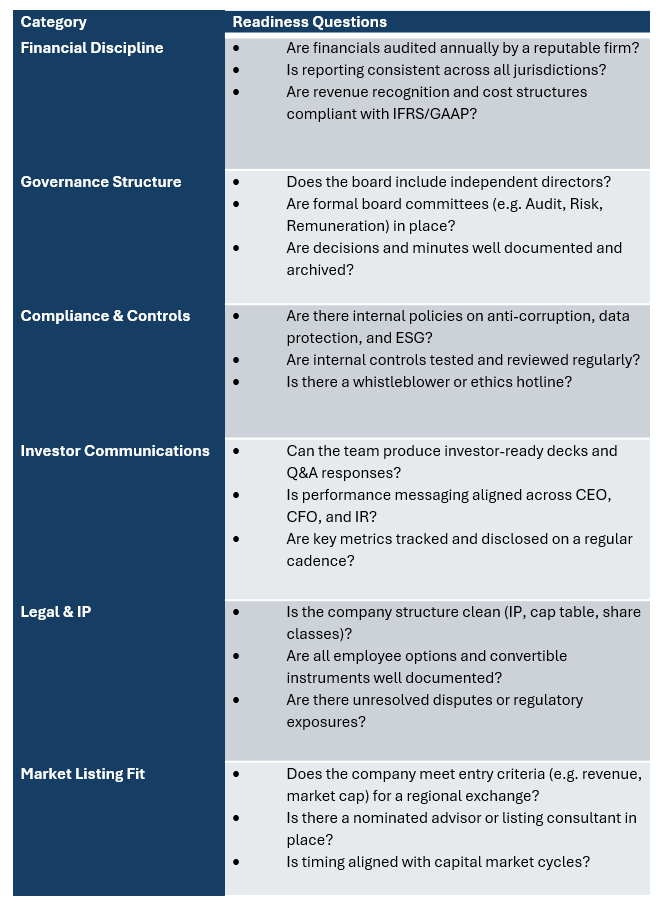

The Canvas: Evaluate IPO readiness even if a public listing is not the chosen path to institutionalize governance, signal maturity, and preserve the option for future IPOs or higher-value M&A.

Why it matters: Most venture-backed exits do not end in an IPO. But the process of preparing for public markets forces companies to professionalize their operations in ways that buyers and later-stage investors value deeply. Auditable financials, formalized governance structures, and robust compliance mechanisms are not just IPO requirements – they are indicators of a company that is exit-ready in any scenario.

Strategic Benefits Of IPO-Style Preparation Include:

- Higher multiples during M&A negotiations

- Greater trust from institutional or strategic acquirers

- Reduced diligence friction and deal acceleration

- Optionality to pivot to public listing when markets open up

Kilimanjaro’s Approach:

In 2026, Kilimanjaro introduces a lightweight “IPO-style readiness audit” across its top five Fund III portfolio companies. The process reveals gaps in board independence, inconsistent audit quality across regions, and limited investor communications planning. The exercise prompts several actions:

- RideConnect scores 84% on the readiness benchmark. This audit helps sharpen governance messaging during M&A discussions with Uber, reinforcing credibility.

- HealthTech Ghana uses IPO-readiness work to strengthen board composition and secure a secondary sale to a healthcare-focused growth fund.

- One company, previously overlooked by buyers, receives an unsolicited acquisition offer after its reporting package and compliance protocols were upgraded.

The firm concludes that IPO preparation – even without listing intent – significantly strengthens exit positioning and investor confidence across the board.

IPO Readiness Checklist: Key Elements To Benchmark

Implementation Tool:

IPO Readiness Checklist, use this tool to benchmark your top 3 companies annually. Even partial readiness work strengthens exit strategy and investor engagement.

– Anthony William Catt, Founder, Ventures 54, Building London Africa Network

Looking Ahead: To Liquidity Flows

Looking at maturing ecosystems, like Singapore, Switzerland and increasingly MENA, there is a clear trend of value creation, or rising MOIC and TVPI , across funds and investment vehicles. Yet, this may not automatically translate into DPI, or liquid cash-on-cash return. It requires both market maturity, skills development and dedicated resources building out the market.

For the entire industry to ‘work’, we need to be able to generate repeatable, sustainable cash flows back to the universe of limited partners. One starting point, use the Exit Journey Toolkit to expand your exit track record.

Want the Exit Journey Toolkit? Download here.