I’ve Recently Reviewed A Series Of Emerging Fund Manager Pitch Decks. It Is Clear That Hours, If Not Years Has Gone Into Them. Yet, They Are All Missing One Key Item. The Limited Partners’ Value Proposition.

Over the last 5 years, I’ve had the chance to work in-depth with emerging fund managers around the world. 250+ GP’s across different strategies, fund structures and markets. 1.000+ participants in the VC Fund Manager Masterclass and running three GP Accelerator programs in collaboration with the team at 2X Ignite.

But it is not just that.

I have also been privileged to sit on the other side of the table.

Advising national fund-of-funds, training some of the largest LP capital allocators in the world for emerging markets, strategy development for family offices; I have also sat with the LPs to try to make sense of the ‘jungle’ that is emerging managers.

Thanks to the teams at Mountside Ventures, TechBBQ and EU.VC, I’ve had first row access to many of the emerging managers in Europe. Thanks to the collaboration with the Newton Venture Program in London, I’ve spent hours and hours discussing how emerging managers can best position themselves to secure LP commitment.

In our own, fund-of-fund structure (small, but growing), I’ve sat across GPs truly struggling to articulate why we should invest and what we might gain from the 10-15 partnership.

What Is A ‘LP Value Proposition’?

A LP Value Proposition is a statement, often a slide, on why the LP should invest. More than that, is captures the unique, personal benefits the LPs that an LP will get.

Different LPs, of course, has different preferences. To some, financial return and governance matters the most. To others, the excitement, network and community matters more. To others, again, co-investments and having an active role matters more. To a German bank, investing into an African seed fund, market access, learning and strategic fit might be the key value proposition.

Point Is, Know Your LPs, Nail The LP Value Proposition.

Here Are Three Examples: How A European Climate Tech €100M Fund Would Pitch A Small Family Office

- Invest alongside a community of 250+ family offices, angels, HNWI and impact foundations

- Join a global network of investors who have built and scaled companies in the climate tech space, including successfully exited founders of X, Y and Z

- Get early access to vetted deals, with full investment memo and LP co-investment rights

- Annual meetings hosted around Europe, with domain deep dives

- Advanced LP learning sessions on deal structuring, term sheets, board dynamics and exits

How A Pacific Impact Fund Would Pitch The Same Family Office

- Invest in a community alongside 8 DFI’s who care deploy about ocean health, climate and sustainability, and a global network of 15 family offices coming together in the mission of protecting the oceans in the Pacific region

- Join a unique, hard-to-get-into-network of high-net-worth family offices, who are looking at ocean and impact investments in a multi-generational lens

- Get unique access to and insights into deals, investments and economic development in the Pacific

- In-depth field trips and annual meetings hosted in the Pacific, bringing you close to the companies and people on the ground

- A unique chance to put your wealth to work for impact and ocean health

- A truly unique chance to let member of your family (Kids, perhaps? Next generation, probably?) spend one week in the Pacific, working alongside our investment team, getting hands-on with dealflow, investment memos, board engagements and portfolio support.

- Build long-term relationships with the fund management team, companies and fellow LPs in the most amazing, beautiful setting on earth

- With our innovative fund structure, get access to liquidity, starting in year 3 and every year after

- Combine an annual site visit with a luxury vacation, where we give you access to sites, locations, restaurants and people you will never find on a travel website.

How A London-Based £20M AI Pre-Seed Fund Would Pitch A HNWI

- Get incredible access to the best AI deals in Europe – before they go to the moon

- Get massive bragging rights on LinkedIn and social media on being an LP in Europe’s most high-flying pre-seed AI fund

- Join an excited, hyped community for weekly check-ins (online) and monthly drink meet ups, often bringing in unicorn founders we invest in – before anybody else have ever heard about them

- Potential for a 10X return – or more – on your AI fund investment

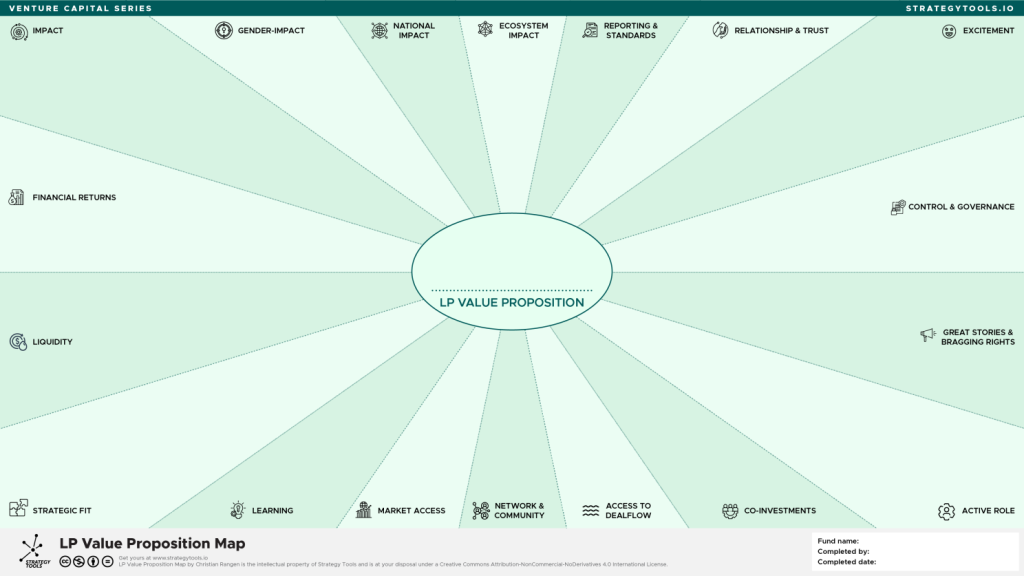

Meet, The LP Value Proposition Map

The stories above can now be re-read, with your eyes on the LP Value Proposition Map. Notice how each of the three examples use different topics in their pitches.

LP Value Proposition Map (Rangen, 2024)

In our work, we have identified 18 unique LP Value Proposition items.

Each LP is likely to have a combination of these. No LP would ever have all of them. Most LPs will have 2-3 items that are the ‘primary’ to them, with another 2-4 that are ‘interesting’

Looking at the LP Value Proposition Map above, you’ll notice it’s not just about financial returns (though those matter enormously). Today’s complex LPs are evaluating funds across multiple dimensions, or through different value propositions.

18 Items in Four Clusters LP Cares About:

Financial Performance Cluster: This is table stakes. Your track record, co-investment opportunities, liquidity profile, and path to superior returns. But here’s the kicker – everyone claims great returns. What’s your differentiated approach to generating alpha and liquidity?

Impact & Purpose Cluster: Many LPs increasingly demand funds that deliver measurable impact alongside returns. Whether it’s gender lens investing, national economic development, or ecosystem building – your story needs to be concrete, measurable, and authentic.

Operational Excellence Cluster: This separates the pros from the pretenders. Your reporting standards, governance structure, strategic fit within their portfolio, and learning opportunities you provide. LPs want to know you’ll be a pleasure or headache to work with for the next decade.

Relationship & Intangibles Cluster: The secret sauce. Your network effects, the excitement factor, the LPs opportunity to get active role in portfolio companies (clearly, not for everyone), and yes – those bragging rights that come with backing the next breakout fund manager.

The Missing Piece In Most Pitch Decks

Here’s what I see repeatedly: Fund managers spend 90% of their pitch talking about their investment thesis, team credentials, and market opportunity. All important. But most completely miss the LP’s perspective.

Your LP Value Proposition Should Answer This Simple Question: “If I Invest In Your Fund, What Specific, Differentiated Value Will I Receive That I Can’t Get Elsewhere?”

Three Steps To Craft Your LP Value Proposition

Step 1: Map Your Unique Strengths

Plot where you genuinely excel across the 18 items. Be brutal in your self-assessment. Where are you truly differentiated vs. merely competitive?

Step 2: Understand Your LP’s Priorities

Different LPs weight these dimensions differently. A sovereign wealth fund cares deeply about national impact. A university endowment might prioritize learning opportunities and bragging rights. A pension fund focuses heavily on governance and reporting standards.

Step 3: Create Your Positioning Statement

This isn’t marketing fluff. It’s a clear, compelling explanation of the specific value you deliver. Think: “We provide [specific LP type] with [unique combination of benefits] that enables them to [achieve specific outcome] in ways that [competitive differentiation].”

The Bottom Line

In a world where LPs are drowning in fund pitches, your value proposition is your lifeline. It’s not enough to be a great investor anymore. You need to be a great partner who delivers value across multiple, highly differentiated dimensions that matter to your LPs.

Stop leading with your investment thesis. Start with your LP Value Proposition. Make it crystal clear why investing in your fund is not just a good investment decision, but a strategic partnership that delivers value far beyond financial returns.

The best fund managers I work with don’t just raise capital – they attract capital by clearly articulating the multidimensional value they deliver to their LP partners.

What’s Your LP Value Proposition? If You Can’t Answer That In Two Sentences, You’ve Got Work To Do.

(Read also part II: Training Emerging Fund Managers: How to Nail the LP Value Proposition)

Chris Rangen is a fund strategy advisor who has worked with 250+ emerging fund managers globally. He runs global VC Masterclasses and teaches at leading programs like IMD’s Venture Asset Management Program, led by Jim Pulcrano (Lausanne), and Newton Venture Program (London).

The work in the VC space is largely thanks to great clients, partners and most of all 250+ emerging fund managers around the world. A big thanks to Marc Penkala, Rick Rasmussen and Scott B. Newton for discussions around this topic. A shoutout to Holger Nils Pohl for helping all of us working visually, and Alexander Osterwalder for helping the world think about value propositions more clearly.

The LP Value Proposition Map is available at strategytools.io under Creative Commons license.