The journey from first contact to final investment is a structured, rigorous process that separates exceptional opportunities from the merely good. Here’s how leading venture capital firms navigate the path to investment.

The venture capital investment process isn’t a single decision—it’s a carefully orchestrated sequence of escalating commitment, deeper understanding, and strategic alignment. From the moment a startup catches a VC’s attention to the final wire transfer, each stage serves a critical purpose in de-risking the investment and building conviction.

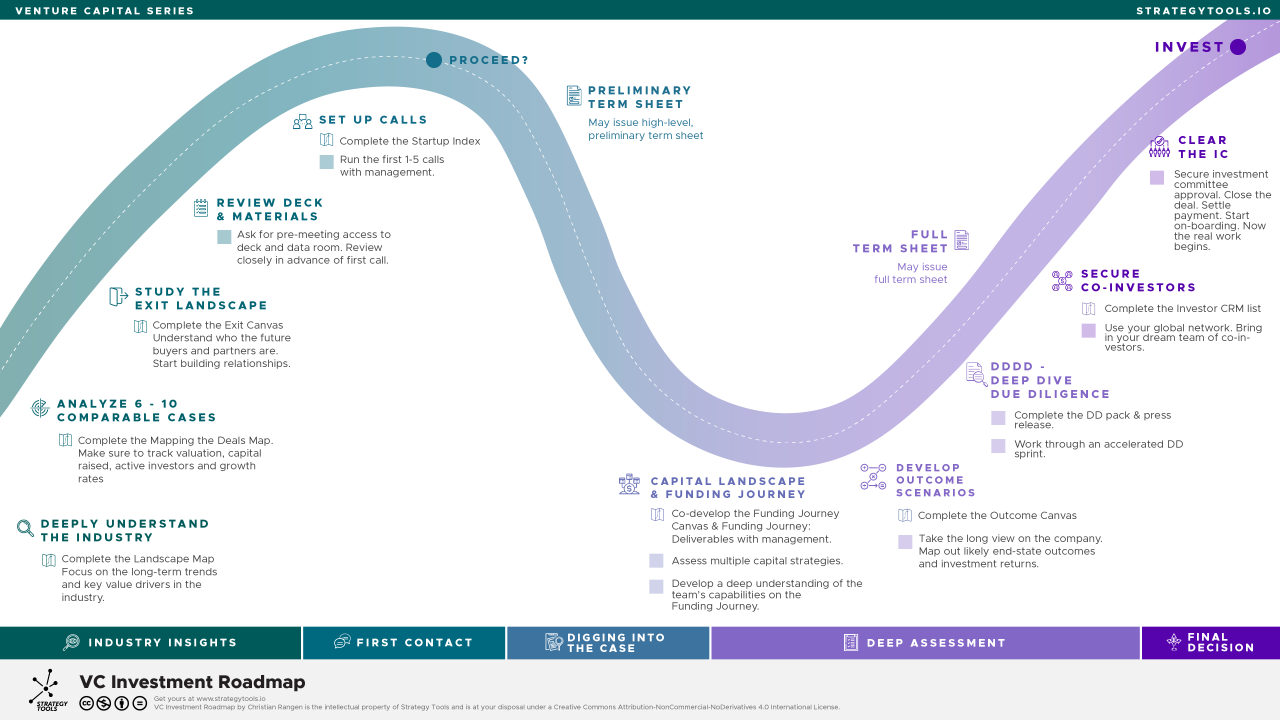

Let’s walk through the five key phases that define how VCs invest, using insights from the VC Investment Roadmap and real-world examples from the Italian venture ecosystem.

Phase 1: Industry Insights – Building Deep Market Intelligence

Before evaluating any single startup, elite VCs invest heavily in understanding the landscape. This isn’t about skimming industry reports—it’s about developing thesis-level insights that inform every investment decision.

The Core Work: Deeply Understand the Industry

The foundation of great investing is deep industry knowledge. Top VCs complete comprehensive landscape mapping exercises that capture:

- Long-term secular trends reshaping the market

- Key value drivers that create defensible positions

- Emerging technologies and business model innovations

- Regulatory shifts and their implications

- Competitive dynamics and consolidation patterns

Key Deliverable: Complete the Landscape Map. This living document becomes the strategic foundation for all deal evaluation in the sector.

Example: When Italian Ventures (fictive name), one of Italy’s early-stage VCs, began building their thesis around B2B SaaS in Southern Europe, they didn’t just track companies—they mapped the entire ecosystem. They analyzed why European SaaS companies trade at different multiples than US counterparts, identified gaps in infrastructure and talent, and recognized that Italian companies building for international markets from day one had fundamentally different trajectories. This deep industry understanding enabled them to spot great deals before competitors recognized their potential.

Phase 2: First Contact – Pattern Recognition at Scale

Once you understand the industry, you can quickly assess whether a startup fits your investment thesis. This phase is about efficient screening and comparative analysis.

The Essential Activities:

Analyze 6-10 Comparable Cases Great investors don’t evaluate companies in isolation. Complete the “Mapping the Deals” map to track:

- Valuation benchmarks and pricing dynamics

- Capital raised and burn rates

- Active investors and syndicate patterns

- Growth rates and unit economics

- Competitive positioning

Study the Exit Landscape Complete the Exit Canvas to understand acquisition targets, strategic buyers, IPO readiness, and partnership opportunities. Start building relationships with potential acquirers now—exit planning begins on day one.

Pro Tip: The best VCs maintain living databases of comparable transactions. When a new opportunity emerges, they can instantly contextualize the valuation, understand if the founding team is experienced relative to peers, and spot outlier metrics that signal exceptional potential or hidden risks.

Phase 3: Digging Into the Case – First Impressions Matter

You’ve identified a promising company. Now it’s time for deeper engagement while maintaining efficiency.

The Critical Steps:

Review Deck & Materials Ask for pre-meeting access to the pitch deck and data room. Review everything closely in advance. Come to the first call with informed questions, not basic clarifications. This signals respect for the founder’s time and demonstrates your preparation.

et Up Calls Run the first 1-5 calls with management. Complete the Startup Index to assess:

- Team composition and capabilities

- Product-market fit evidence

- Go-to-market strategy and execution

- Competitive advantages and moats

- Vision and strategic thinking

Italian Ventures Example: When Italian Ventures first engaged with PayX (now one of Italy’s most successful fintech unicorns before they invested), they didn’t jump straight to term sheets. They spent weeks understanding the buy-now-pay-later landscape in Southern Europe, interviewed merchants using the platform, spoke with competing solutions, and assessed the team’s ability to execute across multiple markets. Their diligence created conviction.

Decision Point: After this phase, you face a critical go/no-go decision. Most deals end here. Only those demonstrating exceptional potential proceed.

Phase 4: Deep Assessment – Building Conviction Through Analysis

For opportunities that pass initial screening, it’s time to build robust investment models and stress-test assumptions.

The Strategic Frameworks:

Capital Landscape & Funding Journey Co-develop the Funding Journey Canvas and Funding Journey Deliverables with management. Understand:

- Complete capitalization history

- Future funding requirements and milestones

- Investor syndicate composition

- Strategic capital partners vs. financial investors

Assess multiple capital strategies. Develop a deep understanding of the team’s capabilities to execute their funding journey. Will they need $5M or $50M to reach their vision? What happens if the next round doesn’t come together? How does their approach compare to successful companies in the sector?

Develop Outcome Scenarios Complete the Outcome Canvas. Take the long view on the company. Map out likely end-state outcomes and investment returns across multiple scenarios:

- Base case: The company executes reasonably well

- Bull case: Everything goes right, category leader emergence

- Bear case: Challenges emerge but value is preserved

- Downside case: What’s the floor on outcomes?

Calculate potential returns under each scenario, probability-weight them, and determine if the risk-adjusted return justifies the investment.

Italian Ventures’ Approach: For their growth stage investments, Italian Ventures models 5-7 detailed scenarios spanning different exit multiples, timelines, and dilution assumptions. They pressure-test their models against historical precedent transactions in the category. Only when multiple reasonable scenarios generate target returns do they proceed.

Decision Point: May issue a preliminary term sheet with high-level terms, signaling serious intent while preserving flexibility for deeper diligence. (Note, from term sheet to signed investment agreement, we usually see ca. 50% conversion rate. Don’t expect a term sheet to be an investment. it’s not. It’s just a stepping stone)

Phase 5: Final Decision – The DDDD Sprint

You’re convinced the opportunity is exceptional. Now it’s time to finalize terms, complete comprehensive diligence, and mobilize your network.

The Four Pillars:

DDDD – Deep Dive Due Diligence Complete the full due diligence package including:

- Legal entity structure and cap table review

- Financial statement audit and reconciliation

- Technical/product diligence (code review, security assessment)

- Market reference calls (customers, partners, former employees)

- Background checks on key executives

Work through an accelerated DD sprint. Prepare the investment memo and draft press release—writing the press release forces clarity on why this investment matters.

Secure Co-Investors Complete the Investor CRM list. Use your global network to bring in your dream team of co-investors. The best investors are additive beyond capital—they bring:

- Domain expertise and pattern recognition

- Network access and business development support

- Operational experience building similar companies

- Follow-on capital capacity for future rounds

Clear the IC Present to the investment committee. Secure approval. The best IC presentations tell a compelling story: Why this market? Why this team? Why now? What could go wrong, and how does the team mitigate those risks?

Invest Close the deal. Settle payment. Start onboarding. Now the real work begins—you’re shifting from evaluator to partner, from outside observer to aligned investor working alongside the founders to build something extraordinary.

Decision Point: Issue the full term sheet with complete terms, conditions, and governance provisions.

The Italian Context: A Maturing Ecosystem

Italy’s venture ecosystem has experienced remarkable growth, with investments reaching €2.1 billion and a 67% increase in recent years. Many firms are professionalizing the investment process and competing on the global stage.

What makes Italian VCs distinctive is their deep understanding of building from Southern Europe while scaling globally. They’ve developed expertise in helping founders navigate cross-border expansion, understand regulatory nuances across European markets, and build teams that can execute in resource-constrained environments.

Key Principles for VCs and Founders

For Venture Capitalists:

- Build industry expertise before deploying capital—deep knowledge creates conviction

- Use structured frameworks to maintain discipline across the investment process

- Invest in pattern recognition by tracking comparable transactions systematically

- Make decisions with incomplete information, but stack the odds through rigorous process

- Remember that clearing the IC is just the beginning—value creation happens post-investment

For Founders Seeking VC Investment:

- Understand that each VC interaction advances you through their process—make every touchpoint count

- Prepare materials in advance—VCs notice when you make their diligence easy

- Articulate your funding journey clearly—show you understand capital strategy

- Build relationships with potential co-investors early—VCs value founders who can help syndicate

- Ask VCs about their process—understanding their timeline helps you manage yours

The Bottom Line

The venture investment process is neither art nor science—it’s both. The best VCs combine rigorous analytical frameworks with pattern recognition and intuition developed over hundreds of evaluations. They maintain discipline through structured processes while remaining flexible enough to move quickly when conviction emerges.

Every phase serves a purpose: building industry knowledge, screening efficiently, assessing deeply, modeling outcomes rigorously, and completing comprehensive diligence. Skip a phase and you introduce risk. Execute each phase well and you dramatically improve your hit rate.

The VC Investment Roadmap provides a battle-tested framework for navigating this journey. Whether you’re a first-time fund manager in Milan or a seasoned GP in Silicon Valley, these principles endure: know your market, compare relentlessly, build conviction through analysis, stress-test assumptions, and move decisively when opportunity emerges.

Ready to upgrade your investment process?

Download the complete VC Investment Roadmap and explore our full suite of strategy tools designed for venture capital investors, startups, and innovation leaders at www.strategytools.io.

This framework is part of the Venture Capital Series by Strategy Tools—empowering VCs, founders, and ecosystem builders with visual thinking tools that drive better decision-making.