A few weeks ago we published “Who attends Scale Up!?” It hit 5,000 views across our platforms in days.

Then someone asked: “Great, but who actually buys Scale Up!?”

Good question. Here’s Part II.

Start With Problems, Not Products

First, the harsh truth: nobody cares about your solution. Even less about your product.

If you’re out there pitching Scale Up!, expect zero uptake.

What people care about:

· “How can we solve our top challenges?”

· “Who can help us solve our biggest problems?”

Over the years, we’ve watched Strategy Tools partners get certified on Scale Up!, excited, ready to sell. They pitch it as a product. Few succeed.

Instead: become a master of problem understanding. Develop deep curiosity about your customers’ challenges. Build empathy with their top priorities.

If the client is a national innovation agency, what keeps them up at night? If it’s a business angel network, what are they wrestling with? Attracting new members (recruitment)? Getting angels invested faster (training)? Moving angels off the bench into deals (process)? Seeing portfolio companies hit breakout velocity (growth support)?

Only when you deeply understand the problem can you start developing the solution - and see where Scale Up! fits in.Five Problems Scale Up! Solves

Looking back at 8 years and 4,000+ participants—founders, investors, innovation agencies—five key problems stand out:

1. Knowledge Gap

Target audience has limited knowledge around equity financing. This is the challenge for 70% of participants.

First-time founders in MENA. Pre-seed founders in Africa. Ecosystem developers in the Nordics. They need the building blocks. Nothing fancy. Just the basics.

The question: How can we learn more about equity financing—in a new, engaging format?

2. Fundraising Readiness

Founders need to get investor-ready and close their round. Whether they’re in a European accelerator or an Egyptian investment readiness program, these founders are laser-focused on fundraising.

The question: How can we best prepare founders for their upcoming funding rounds?

3. Late-Stage Growth

Many participants understand early-stage well but struggle with later stages. Series A and beyond. Complex term sheets. Outcome analysis. Exit paths. Partial secondaries. IPO transactions.

Senior bankers in Europe. Global consultants. Late-stage founders in MENA. They’re ready to dive deep into Series B complexity and IPO roadmaps.

The question: How can we help people master the later stages, from Series A to successful exit?

4. Mastery

Fund-of-funds. VC firms. Senior accelerator staff. Experienced angels. Family offices.

These players have solid fundamentals. Strong grasp of early-stage challenges. But they want more. They seek mastery. They want to feel deep confidence throughout the entire journey.

Experienced VCs. Investment directors. Professional allocators. People investing daily who want to level up.

The question: How can your top people build and expand their skills in entrepreneurial finance and growth strategy to elite levels?

5. Shared Team Understanding

The newest challenge: team alignment. Building shared understanding. Team development in the investment space.

Family offices. Consulting firms. Corporate innovation teams. Innovation clusters. Ecosystem developers. Capital coaches.

They all need joint, collective understanding of equity financing, growth strategy, and exit readiness.

The question: How can 50+ ecosystem developers develop a strong shared language and common understanding of the founder’s journey—while having a great time together?

________________________________________

So, start with the challenges. Deeply understand the problems you aim to solve.Then move to Part II:

Who Are The Buyers?

1. Innovation Agencies (IA)

Tasked with developing national or regional startup ecosystems. Usually publicly funded with large mandates. They fund programs, support accelerators, offer grants and early-stage financing.

They balance ecosystem development with financing solutions. Most have clear ecosystem mandates and a long list of challenges Scale Up! addresses perfectly.

Examples:

- InnovateBC (Canada)

- Innovation Norway (Norway)

- DIFC Ignyte (UAE)

2. Entrepreneurship Development Organizations (EDO)

Tasked with large-scale capacity building and ecosystem development. These organizations have extensive development mandates, often multi-year horizons.

Usually not investing directly—they support development work. Often focused on emerging markets and emerging ecosystems, serving large founder populations while developing accelerators, incubators, angel networks, and ecosystem initiatives.

Examples:

- EBRD Star Venture (Europe, emerging markets)

- GIZ (Germany, global)

- Swiss Entrepreneurship Program (selected emerging markets)

- United Nations YECO (global south)

3. Investment Organizations (IO)

Closely tied to development organizations, with one major difference: they invest. Direct mandates. Indirect mandates. Sometimes they’re foundations seeking ecosystem impact, capacity development, and financial returns. Other times they’re financially oriented, primarily seeking returns.

Examples:

- 2X Global

4. Entrepreneurship Network Organizations (ENO)

Membership-based or community-based. Some charge fees, others don’t. Most have member lists, active community channels, regular events and programs.

Budgets can be challenging, but these organizations hold highly trusted positions in their ecosystems. Large communities of highly engaged members. When they host Scale Up!, people show up ready to work.

Examples:

- EO (UAE, global)

- 1entrepreneur (UAE)

5. Ministries & National Development Organizations (M+NDO)

Anchored in ambitious national strategies. Bold mandates to drive national entrepreneurship at scale. Different from innovation agencies—bigger aspirations, bolder ambitions.

Often linked to national visions and large-scale programs. Funding big initiatives, usually in collaboration with partner organizations.

Examples:

- Tamkeen (Bahrain)

- Digital Switzerland (Switzerland)

6. Accelerators (ACC)

Well-known to most, but with very different business models.

First group: non-profit, development mandate, significant government funding. Second group: strong corporate partnerships, maybe 100% corporate funding. Third group: fully commercial, funding-for-equity model, long-term success tied to portfolio performance.

Accelerators are a perfect fit for Scale Up!—often tied to longer, more extensive investor readiness modules. We run 3-day, 5-day, 30-day, and 90-day programs.

Examples:

- Katapult Accelerator (Norway, global)

- Savant Deeptech (South Africa)

- Madica Ventures (Africa)

- Hatch Blue (global)

7. Incubators (INC)

Should be big Scale Up! users. Never had a commercial contract yet.

Something to change in the future.

8. Angel Networks (AN)

A large buyer group for Scale Up Angel! Masterclasses and programs. From North Africa to Norway, we’ve run multiple programs with rave reviews.

Like accelerators, this is a superb fit with Scale Up!

Examples:

- Tiye Angels (Egypt)

- Connect BAN (Norway)

9. Family Offices (FO)

Seems unexpected, but investment teams at family offices e big Scale Up! fans. Often using it as an anchor in larger collaborations.

One family office took their entire investment team for a multi-day deep dive. Highlighted multiple relevant topics for further work.

Looking ahead, we’d love to see many more.

Examples:

- European family office investing in emerging markets

- Norwegian family office investing in global startups and funds

10. National Fund-of-Funds (FoF)

Similar to organizations listed above, with one key difference: they hold vast portfolios. Direct investments, plus indirect via fund investments.

This double investing role exposes them to much larger portfolios than any regular fund.

Perfect mandate between ecosystem development, national development, and financial returns. Scale Up! can be a superb support—even an accelerant—across the startup portfolio. Ideally structured as part of a larger program engagement.

Examples:

- Norwegian state national fund-of-funds

11. VC Firms (VC)

Should be a superb fit and active buyers. But few have dedicated budgets for portfolio development outside their own teams.

Some VC firms run accelerators (see above).

Examples:

- ThinkZone (Vietnam)

12. Business Schools (BizS)

We love bringing Scale Up! to business schools.

Any school teaching entrepreneurship, Entrepreneurship 101, or entrepreneurial finance should have Scale Up! as a core teaching activity.

Today, Scale Up! is used in business schools across California, Austria, Germany, Italy, Belgium, and Canada. But there’s huge opportunity globally.

Examples:

13. High Schools (HS)

Not many high schools have picked up Scale Up! yet. In Canada, Stuart and Michael are teaching multiple high school programs.

An area to explore globally.

Examples:

- InspireTech Canada

14. Innovation Clusters (IC)

With 7,000 innovation clusters globally, they’re perfectly positioned to support entrepreneurship development.

In Norway, hundreds of cluster leaders have been through Scale Up!—making clusters more entrepreneurial-minded, introducing them to equity financing, cap tables, and investor landscapes.

Examples:

- Canada’s Ocean Supercluster (Canada)

- NCE Seafood Innovation (Norway)

- GCE Ocean (Norway)

- National cluster program (Norway)

15. Consulting Firms (Cons)

Many consulting firms offer services around growth strategy, startup financing, and capital strategy. Many come to Strategy Tools for their own development.

Over the years, we’ve worked with professional services firms and advisory firms on Scale Up!, entrepreneurial ecosystems, and investor readiness.

Examples:

- Accenture / Founder’s Intelligence

16. Corporate Venture Capital Units (CVC)

We realized while writing this: we’ve never completed a program with CVC units. Many conversations. None have landed.

We’ll change that in 2026.

CVC units are an obvious fit with Scale Up!

17. Corporate Innovation Teams (InnoT)

Running corporate innovation teams through Scale Up! is always fun. In some ways, it’s entirely new territory for them. Yet they appreciate how much there is to learn: equity finance, cap tables, valuation methods, exit paths, deal structures.

Examples:

- Aker Solutions Innovation team

18. Banks (BANK)

We love working with banks on Scale Up! See potential for many more.

Every bank with any service for founders and entrepreneurs should immediately put their teams through Scale Up!

“I had no idea how hard this could be,” said one banker going through later stages of Scale Up! last year.

Examples:

But Wait—What About Founders?

Notice we didn’t list ‘founders’ here.

Founders are our key users and participants. But in our business model, founders usually don’t pay. Their supporting infrastructure organizations do.

While founders are avid participants, they’re typically supported with financing from the organizations listed above.

The Common Thread

We identified 18 unique groups of participants in “Who attends Scale Up!?” In this article, we’ve spotted 18 unique groups of buyers—organizations with a need, mandate, and budget for Scale Up!

The common thread? Strengthening startup ecosystems.

What Is Scale Up!?

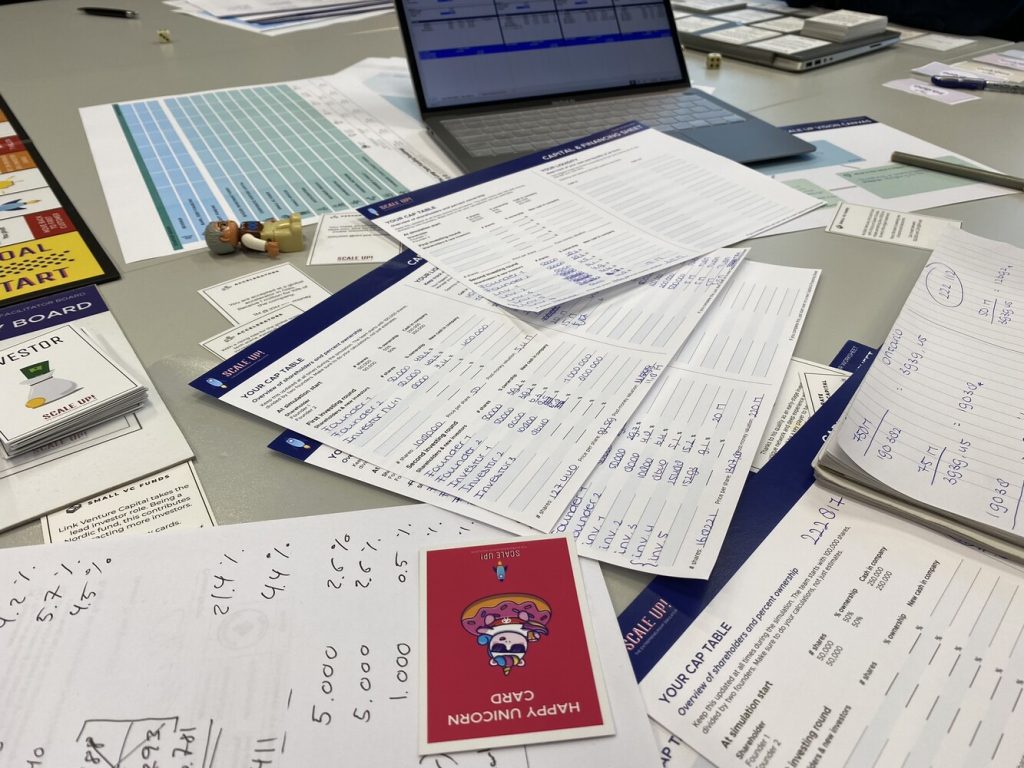

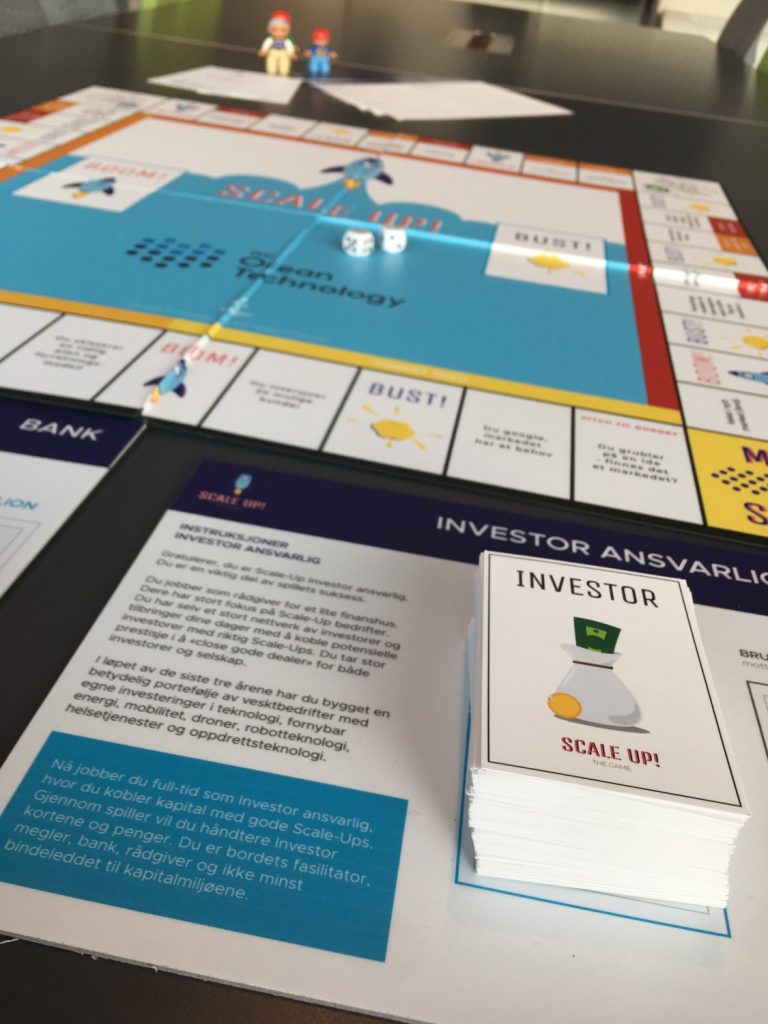

Scale Up! is a team-based, action-packed, ultra-competitive simulation to learn and master the founder’s journey from idea to successful exit.

Working in teams, participants choose a case company, then work through 6-10 years to scale it into a global winner.

To date, more than 4,000 people have completed Scale Up!

Scale Up! covers:

- Scaling mindset

- Foundational equity

- Customer discovery

- Business models

- Revenue growth (ARR)

- Fundraising (SAFE, CLA, Equity) from pre-seed to Series F

- Term sheets

- Outcome analysis

- Partial investor liquidity

- Full exit transactions

Scale Up! is available in:

- Scale Up Global! (global content)

- Scale Up MENA! (100% MENA content)

- Scale Up! Angel (for angel investors)

- Scale Up Africa Rising! (launching Q1 2026)

Learn More? Get Certified?

Want to learn more about Scale Up, Scale Up MENA or Scale Up Angel? Check out our website.

Curious to dig into the full Strategy Sims universe and learn more about the methodology, get our latest report, Strategy Sims in Action, co-authored by a global community of Scale Up! experts.